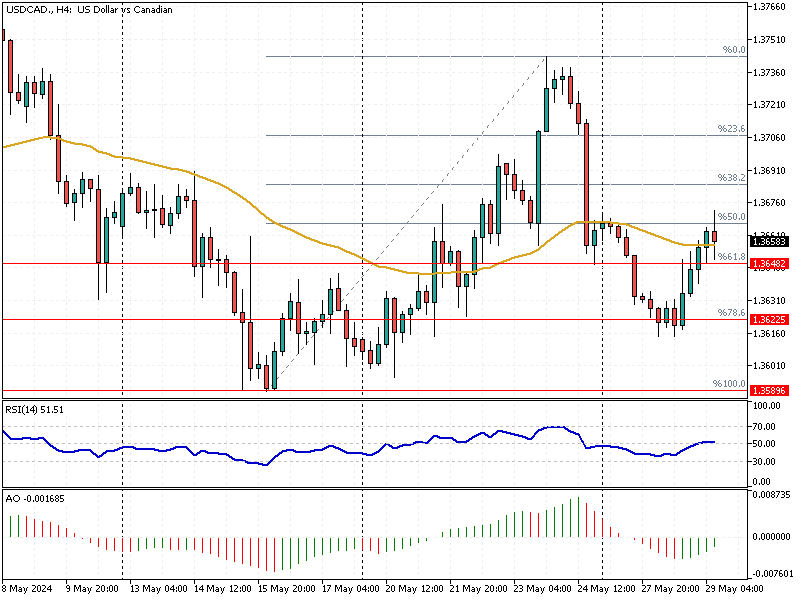

USDCAD Analysis – May-29-2024

USD/CAD Analysis—The Canadian dollar recently strengthened to 1.36 per USD, recovering from a low of 1.373 USD observed on May 23rd. This rebound was driven by a retreat in the US dollar and higher oil prices, which boosted the loonie with the potential for foreign currency inflows.

Despite this, recent inflation data suggests that the Bank of Canada (BoC) may be considering a cut in interest rates next month.

USDCAD Analysis – May-29-2024

USDCAD Analysis – May-29-2024

April’s headline inflation in Canada slowed to 2.7%, marking a three-year low, while the core rate fell to 1.6%, its lowest since 2021. These figures indicate a cooling of inflation, which supports the possibility of a rate cut. Interest rate futures show that about half of the market expects a BoC rate cut in June, which has limited support for the Canadian dollar.

Investors are also awaiting GDP figures due later this week, which are expected to reveal growth in the Canadian economy. This data will be crucial in shaping the BoC’s decision on interest rates.

On the other hand, the US Federal Reserve’s recent minutes revealed ongoing concerns about persistent inflationary pressures in the US economy. Some Federal Open Market Committee (FOMC) members are prepared to implement additional monetary tightening measures if necessary.

Conclusion

In summary, the Canadian dollar’s recent movements reflect a complex interplay of factors, including oil prices, US dollar fluctuations, and differing monetary policy outlooks between Canada and the US. Investors should stay informed on upcoming economic data and central bank decisions to make well-informed financial decisions.