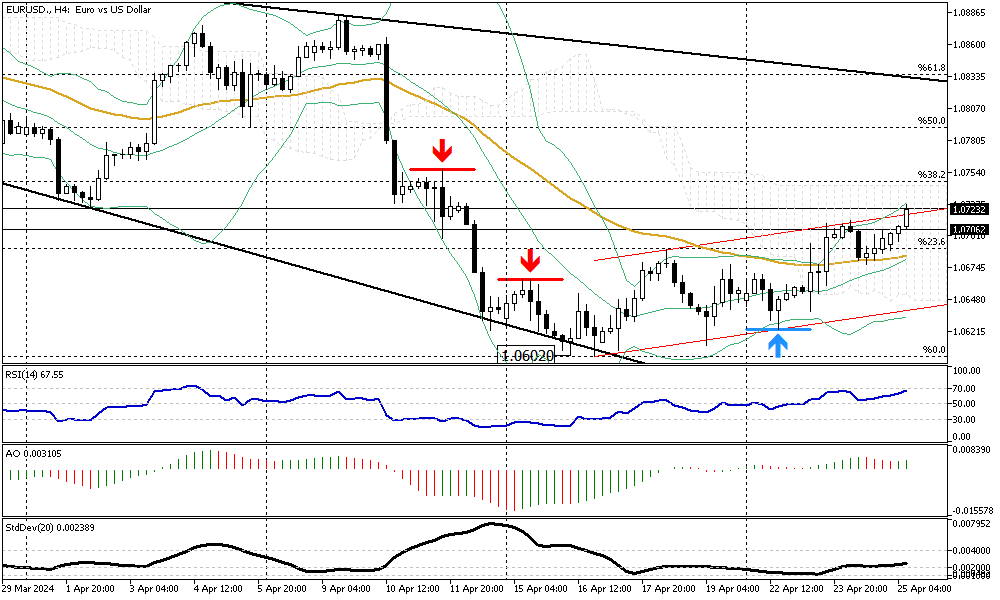

EURUSD Analysis: Inflation Dampens Rate Cut Hopes

EURUSD Analysis – The euro has been trading above $1.065, though it hovers near its weakest point since early November. This movement comes as investors process unexpectedly strong flash Purchasing Managers’ Index (PMI) data from major European economies. The recent PMI surveys indicated that business activity in the Eurozone saw its most significant growth in almost a year this April, with Germany experiencing growth after nine consecutive months of contraction.

Shifts in Monetary Policy Expectations

European Central Bank (ECB) officials have recently indicated a readiness to lower borrowing costs, possibly starting as early as June. Policy discussions have even discussed implementing up to three rate cuts by the end of 2024.

However, this sentiment is tempered by the market’s changing expectations, influenced by sustained inflationary pressures and the robust economic signs emerging from the US. These factors have slowed expectations for rate cuts by both the ECB and the Federal Reserve within this year.

Market Reactions and Outlook

As a result of these developments, the financial markets have a nuanced sentiment. While the initial reaction to strong economic indicators and policy statements was optimistic, the persisting inflation and economic stamina in the US have made investors more cautious.

This cautious outlook is reflected in the euro’s current positioning close to its recent lows, highlighting the complex interplay of regional economic performances and global monetary policies.