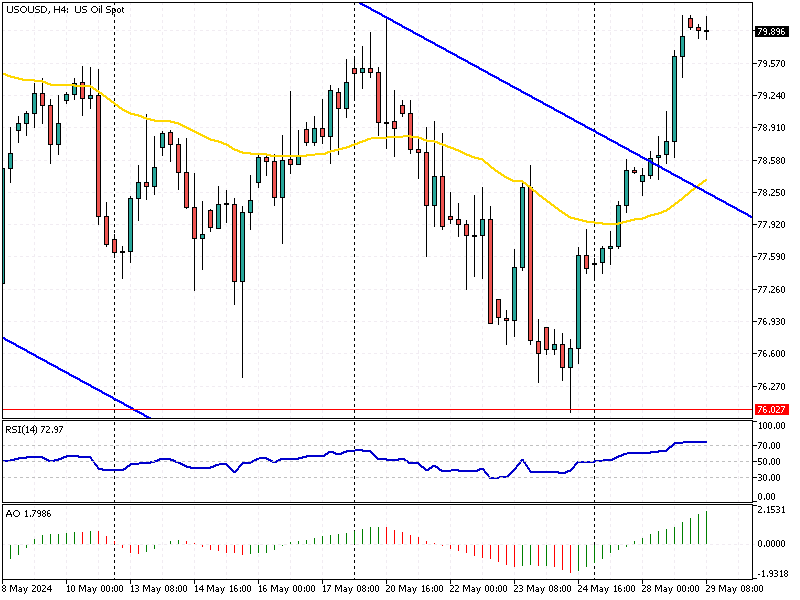

Crude Oil Analysis – May-29-2024

Crude Oil Analysis—WTI crude futures held steady above $80 per barrel on Wednesday, maintaining their highest levels in four weeks. This stability comes amid expectations that OPEC+ countries will extend their voluntary output cuts of about 2.2 million barrels per day into the third quarter. A critical meeting this weekend could confirm these cuts.

Crude Oil Analysis – May-29-2024

Crude Oil Analysis – May-29-2024

Geopolitical issues in the Middle East continue to support high oil prices. Increased fighting in the Gaza Strip and another vessel attack in the Red Sea contribute to these concerns.

On the demand side, the start of the peak summer season is expected to increase fuel consumption in the US, further supporting oil prices. As temperatures rise, so do energy needs, pushing prices upward.

Investors are also monitoring a key US inflation report this week. The outcome will help assess the future of Federal Reserve monetary policy. If the US PCE price index shows softer-than-expected inflation, it could lead to earlier interest rate cuts. This would support economic growth and, consequently, energy demand.

Conclusion

In summary, the combination of OPEC+ output cuts, geopolitical tensions, and rising summer demand in the US are driving oil prices. Additionally, the upcoming US inflation data could influence future market trends. Staying informed about these factors will help in making better economic decisions.