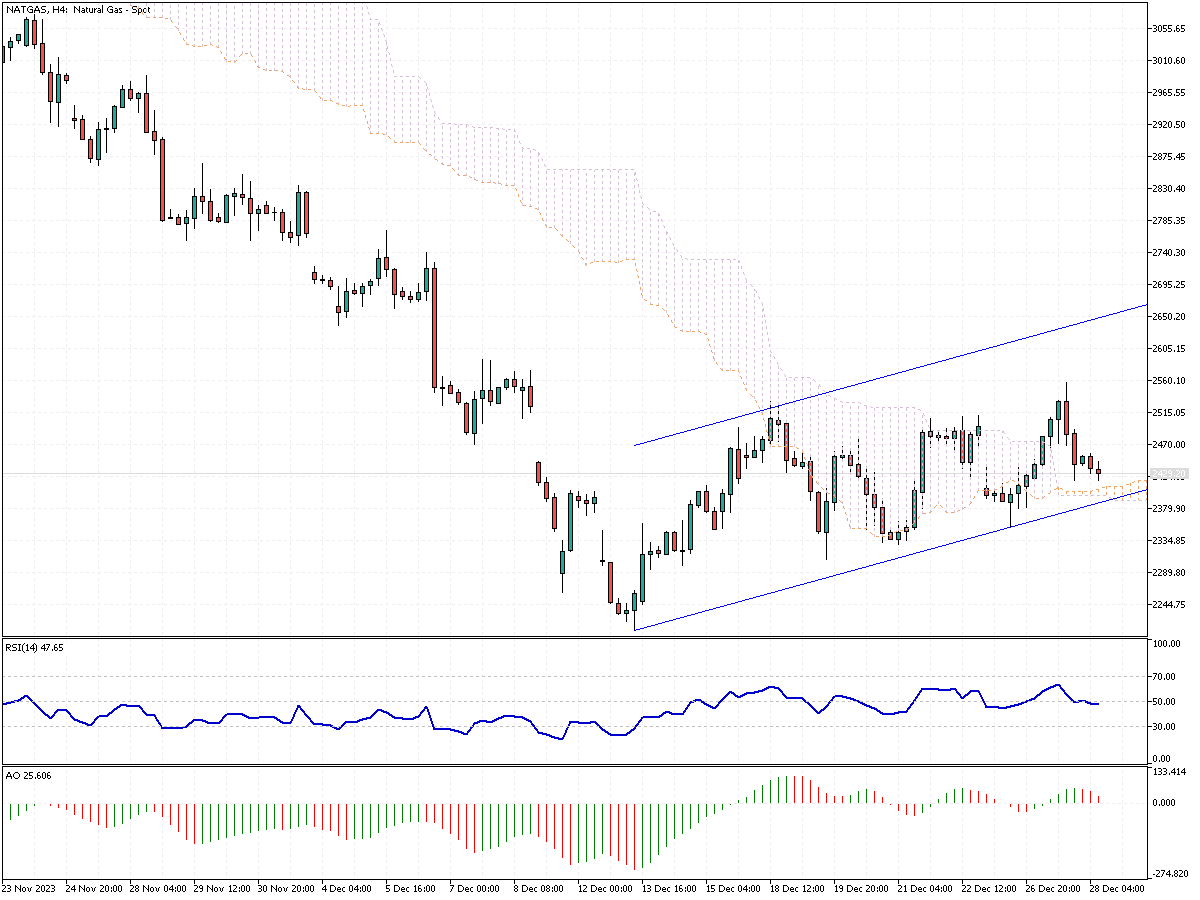

US Natural Gas Analysis – December-28-2023

FxNews – In 2023, US natural gas futures dramatically fell, dropping almost 40% to around $2.5/MMBtu. This is the most significant decrease since 2006, following a 10% gain in 2022. This steep decline is the oversupply, with domestic production reaching record highs. This allowed utilities to increase their reserves significantly, with current inventory levels 8.5% higher than the usual seasonal average.

The Energy Information Administration (EIA), responsible for collecting and analyzing energy data, links the surplus in natural gas to two main factors. Firstly, there’s been a spike in production. Secondly, the winter season has been warmer than average, leading to less demand for heating. Predictions suggest a 4% decrease in the need for heating compared to the past decade, resulting in a 2% reduction in space heating consumption from the average of the last five years.

US Natural Gas Futures Analysis: LNG Export Delays

Looking ahead, there’s an expectation that natural gas prices might bounce back. The anticipated increase in demand from new US LNG export plants fuels this optimism. These US, Canada, and Mexico plants convert natural gas into liquefied form for more accessible global transport. However, market predictions for 2024 might be affected by delays in significant projects. Delays at Exxon Mobil, a worldwide oil and gas leader, and Qatar Energy’s LNG export plants in Texas and the Venture Global LNG facility in Louisiana are significant factors that could alter the market dynamics.