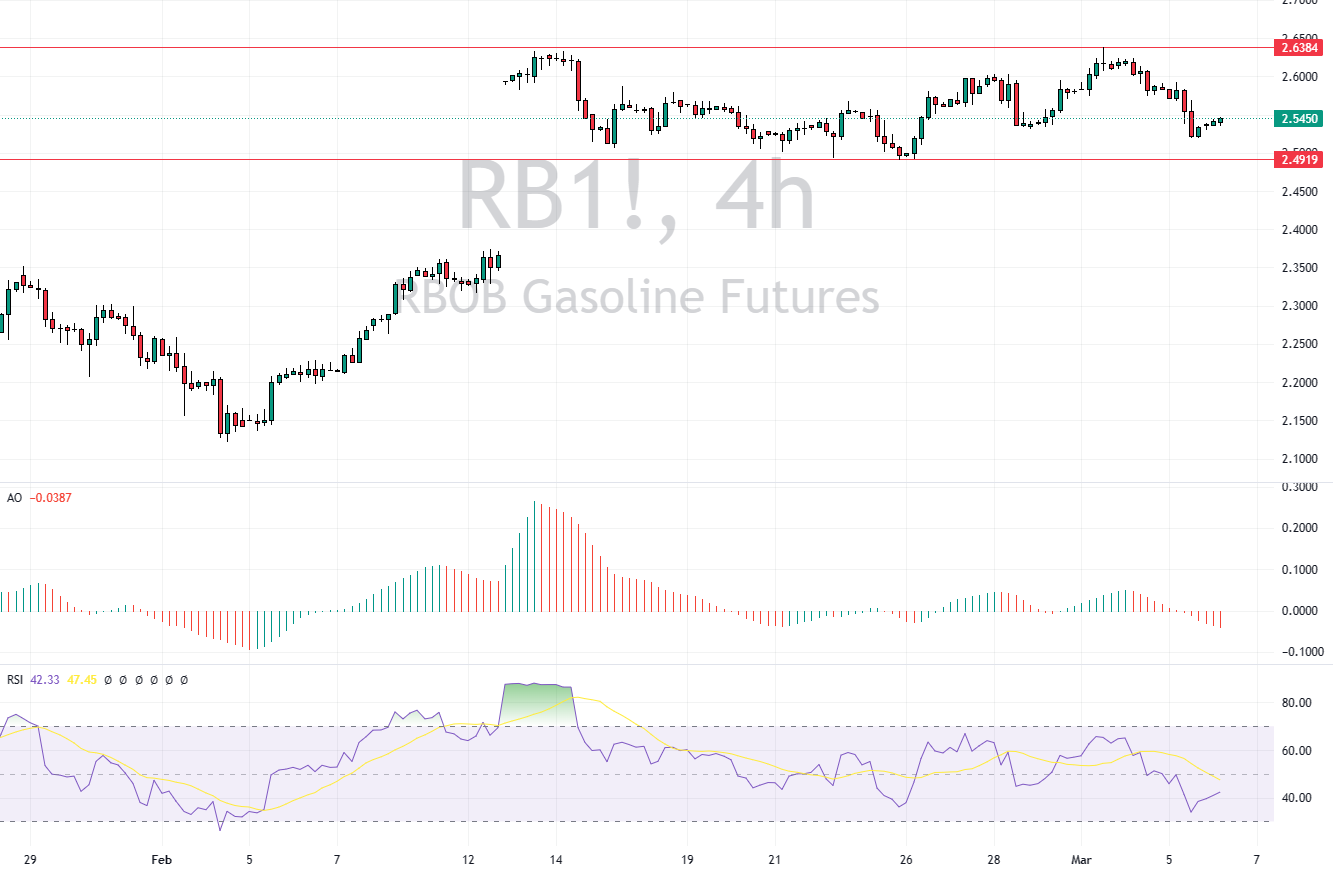

US Gasoline Analysis – February-28-2024

US Gasoline Analysis – Gas prices hover around $2.60 per gallon, near their highest in five months. This is mainly due to a shortage in supply. OPEC and its partners decided to keep their oil production low until the end of June. Saudi Arabia has cut its oil production by 1 million barrels each day.

This cut will last until the end of the second quarter. Russia is also cutting back, reducing its output and exports by 471,000 barrels daily. Meanwhile, Iraq and the UAE are cutting their oil outputs, too, by 220,000 and 163,000 barrels per day, respectively. They plan to continue this until the end of June.

Middle East Tensions and Their Impact on Oil

The situation in the Middle East is making things more uncertain. Talks to stop fighting between Israel and Hamas are ongoing. At the same time, there have been attacks on ships in the Red Sea by the Houthi group.

These events are causing more worry about the region’s stability. This adds more risk to the global oil supply. People are watching closely to see how these tensions will affect the availability and price of oil.

The Declining US Gasoline Stockpiles

In the US, gasoline stocks are dropping. Reports suggest they have fallen by 1.6 million barrels recently. This is the fifth consecutive time they’ve gone down. Before this, there was a more significant decrease of 2.832 million barrels.

This consistent decline in gasoline inventories contributes to the pump’s higher prices. It’s a trend that has many worried about the future of fuel costs and availability.