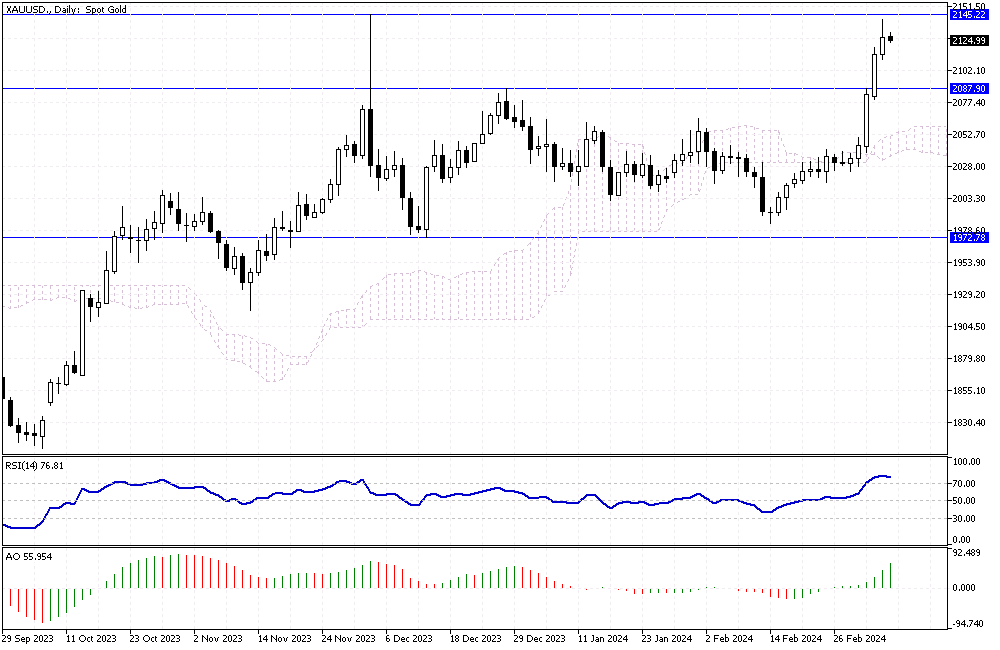

Gold Analysis – March-6-2024

Gold Analysis – Gold prices slightly decreased, reaching $2,120 per ounce. This happened because investors hesitated to make big moves before important events. They were mainly waiting for Federal Reserve Chair Jerome Powell’s speeches in front of the US Congress on two consecutive days.

During these sessions, he might give hints about potential changes in interest rates in the upcoming year. Additionally, the economic world is looking forward to the US monthly jobs report, expected on Friday, which could provide more insights into future financial decisions.

Recent Highs and Economic Data Impact on Gold

On Tuesday, the price of gold reached new highs, showing that investors are paying close attention to the US economic indicators. The latest data on factory orders and the services sector suggested a slowdown in the US economy.

This situation has led investors to believe the Federal Reserve might reduce interest rates this year. Lower interest rates can make gold, which doesn’t yield interest, more appealing than other investments. This anticipation has influenced the recent surge in gold prices.

Global Interest Rate Decisions and Their Influence

Besides the Federal Reserve, the European Central Bank’s (ECB) decision on monetary policy, scheduled for Thursday, is also highly awaited. Investors around the globe are keen to understand how different central banks will navigate their interest rates, as these decisions have significant impacts on global markets, including gold.

The outcome of these meetings can provide critical direction for the financial markets and influence gold prices, as changes in interest rates often affect investment choices worldwide.