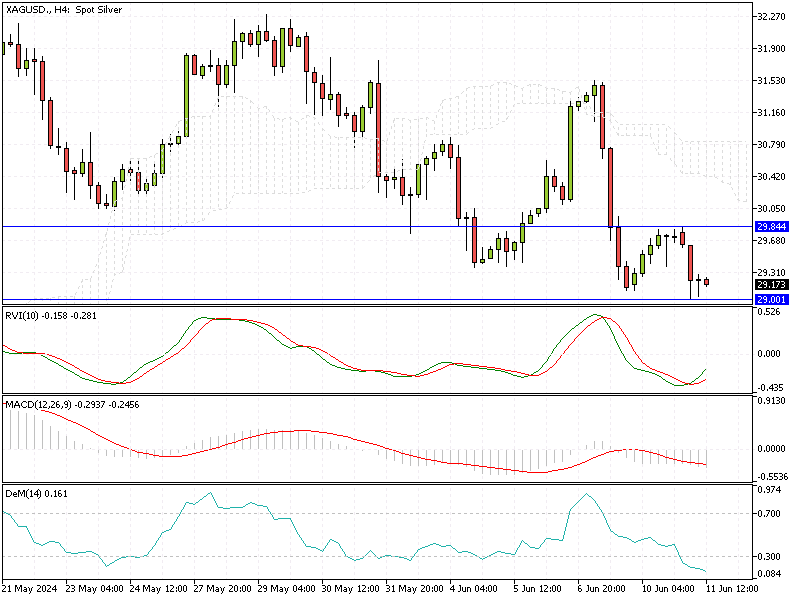

Silver Analysis – 11-June-2024

Silver prices have recently dropped below $30 per ounce, a significant fall from the 11-year high of $32 reached on May 28th. This decline aligns with a broader decrease in precious metals, influenced by positive economic data from the United States.

Silver Analysis – 11-June-2024

Fed’s Hawkish Stance Hits Silver Prices

Non-farm solid payroll numbers for May indicate a robust labor market, which has led to a more hawkish stance from the Federal Reserve. This scenario has increased pressure on US Treasuries and reduced the attractiveness of non-yielding bullion assets like silver.

Additionally, the People’s Bank of China (PBoC) has paused its gold purchasing streak, a critical driver of precious metals’ strong performance earlier this year. This pause has also contributed to the decline in silver prices.

US Tariffs on Chinese Solar Cells Surge

Moreover, the US has imposed 50% tariffs on Chinese imports of solar cells. This sector is one of the most significant industrial uses of silver, particularly in producing solar panels. The tariffs aim to reduce output from key factories in China, potentially impacting global silver demand.

Xinjiang Leads China’s Silver Market Stability

Despite these challenges, strong domestic demand in China has helped stabilize silver prices. The world’s largest in northwestern Xinjiang highlights China’s significant interest in silver, preventing further price drops.

Summary

Investors should consider these economic indicators and geopolitical developments when deciding on silver investments. Understanding these dynamics can help you navigate the complex market and make more informed investment choices.