Recent Shift in Silver Prices

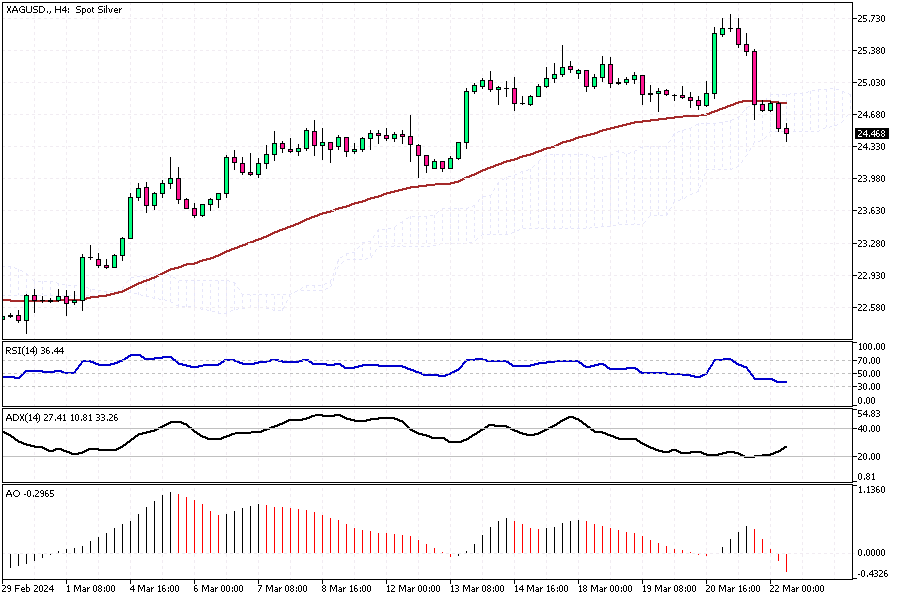

Silver Analysis – Silver prices have dropped to approximately $25 per ounce, a decrease from the nearly one-year highs they reached previously. This change occurred after Federal Reserve officials kept their forecast for three interest rate cuts in 2024, boosting interest in non-yielding assets.

Central Banks and Silver’s Outlook

Investors are now turning their attention to upcoming central bank meetings. They are keen to determine when the easing cycle might begin, which could further influence silver prices. Additionally, monitoring these financial events helps investors make informed decisions.

Bank of England’s Steady Approach

The Bank of England recently held its interest rates steady, aligning with market expectations. However, a notable development was that two of its members ceased their previous calls for increased tightening. This decision indicates a shift in perspective that could affect the market.

Swiss National Bank’s Unexpected Move

Surprisingly, the Swiss National Bank became the first significant regulator to lower its benchmark rate by 25 basis points. This unexpected decision has stirred the markets and could potentially lead to changes in global financial strategies.

Enhancing Content for Better Engagement

To align with Google’s helpful content policy, it’s essential to understand how these financial shifts can impact investors. For those holding or considering investing in silver, these changes in central bank policies could influence the market’s direction.

Therefore, staying informed and analyzing these developments is crucial for strategic investment decisions. Additionally, understanding the broader economic context can help investors navigate these uncertain times more confidently.