US500 Analysis – December-20-2023

On Wednesday, US stock futures showed minimal changes, following a continued robust rally towards the year’s end. This surge saw the Dow and Nasdaq 100 reach new record highs. However, in after-hours trading, FedEx experienced a significant drop of 10% due to less-than-expected quarterly results.

During Tuesday’s regular trading session, the Dow increased by 0.68%, the S&P 500 went up by 0.59%, and the Nasdaq Composite rose by 0.66%. This upward movement was uniform across all 11 S&P sectors, with energy, communication services, and materials leading the gains. All three major indexes are on track to positively close the month and the year, primarily fueled by the fourth-quarter surge. This optimism is rooted in the growing belief that the Federal Reserve might reduce interest rates in the coming year. The hope for a ‘soft landing’ from the central bank has also further boosted market morale.

On Tuesday, notable movements were seen in the large-cap sector. Tesla advanced by 2%, and Meta Platforms increased by 1.7%. Conversely, Nvidia saw a slight decline, falling by 0.9%.

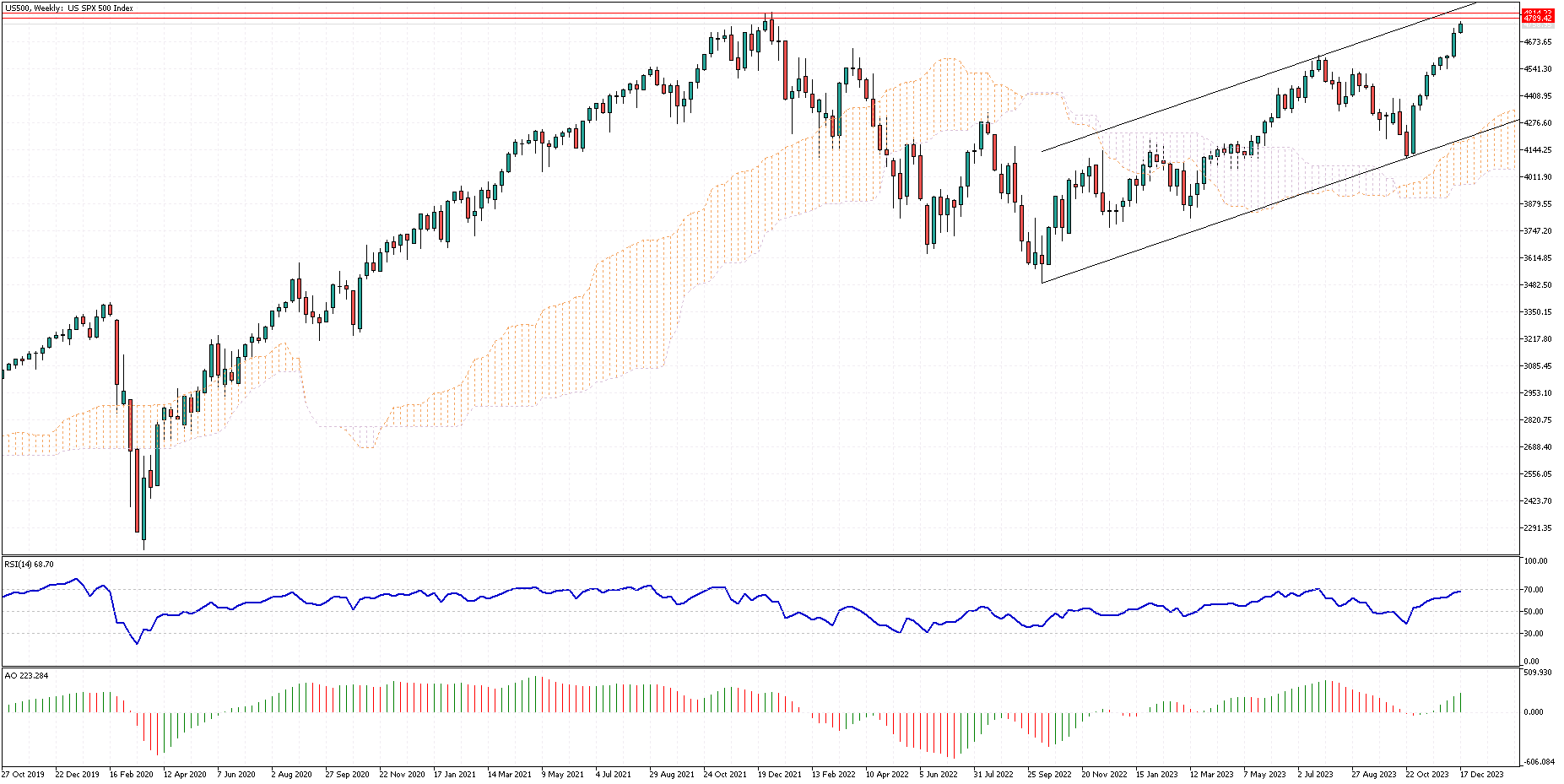

US500 Analysis – Weekly Chart