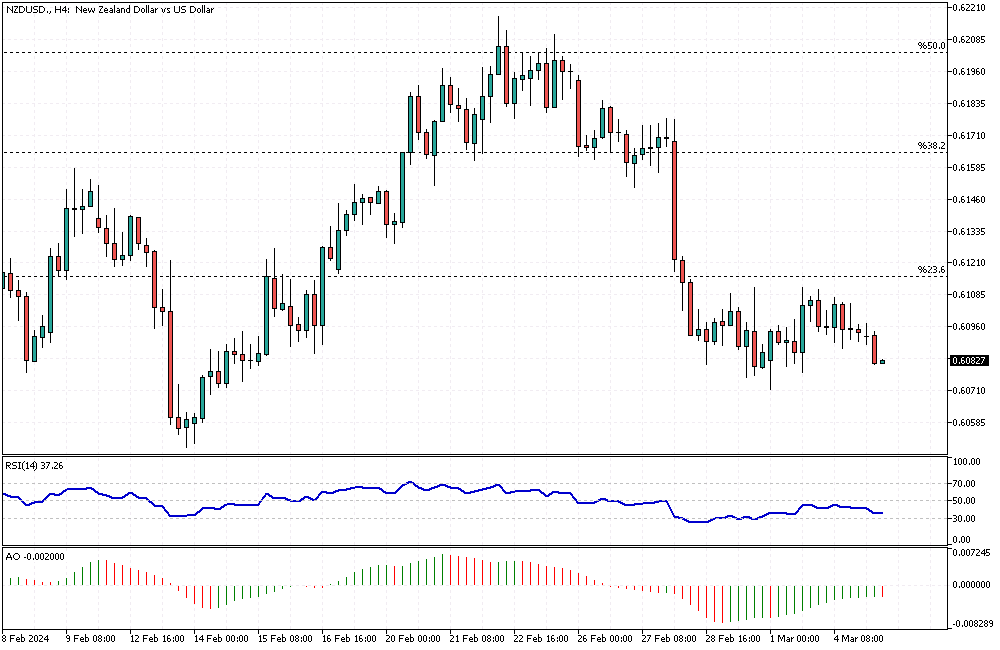

NZDUSD Analysis – March-5-2024

NZDUSD Analysis – The New Zealand dollar experienced a decrease, falling below the $0.61 mark. This decline marks the currency’s lowest point in the past two weeks. This shift occurred as the Reserve Bank of New Zealand (RBNZ) maintained the status quo on interest rates at their February gathering, presenting a less aggressive stance on future monetary policies than was previously anticipated by investors. The decision reflects a cautious approach by the RBNZ amidst global economic uncertainties.

Reserve Bank’s Steady Stance on Interest Rates

In its recent monetary policy update, the RBNZ decided to keep the official cash rate on hold at 5.5%, which did not surprise market analysts. This decision marks the fifth consecutive meeting where the rate has remained unchanged.

The central bank has significantly adjusted its expectations, indicating a slight reduction in the anticipated peak rate to 5.6% from the earlier prediction of 5.7%. This revision suggests that the RBNZ believes previous rate hikes have begun to temper inflationary pressures effectively.

RBNZ’s Inflation Management and Market Reactions

Adrian Orr, the Governor of the RBNZ, expressed confidence that the existing monetary policy framework, particularly the current official cash rate, is sufficiently stringent to mitigate excessive demand within the economy. He also anticipates that inflation will stabilize within the targeted range of 1% to 3% over the current year.

Following these announcements, market expectations for a rate increase in May have notably declined, moving from a nearly 50% probability to just 20%. This adjustment in market sentiment underscores the broader impacts of RBNZ’s monetary strategies on economic forecasts and investor behavior.