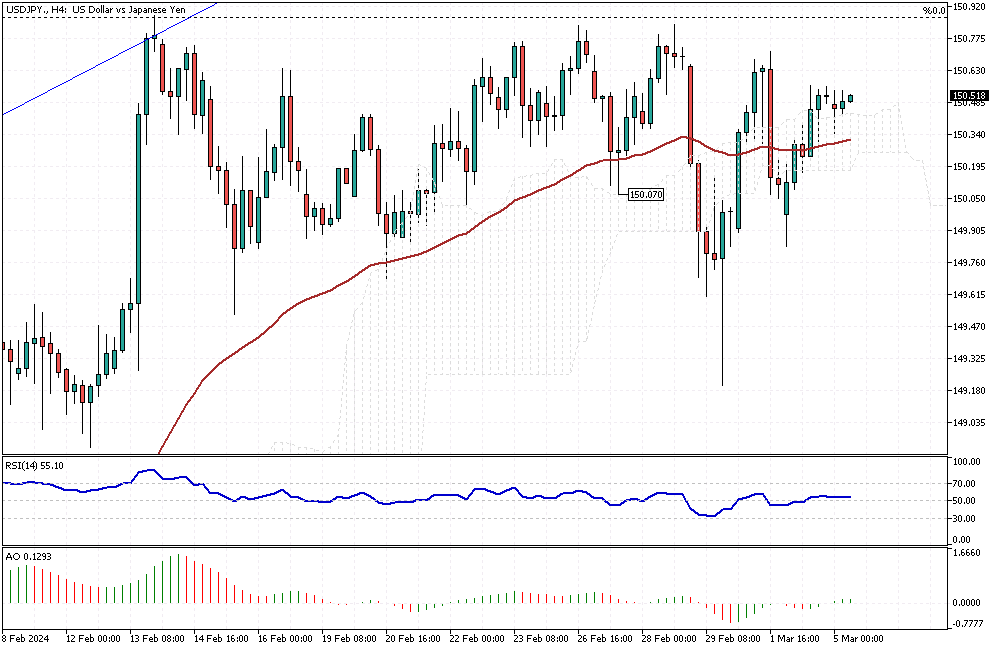

USDJPY Analysis – March-5-2024

USDJPY Analysis – The Japanese yen has recently stabilized at about 150.5 against the dollar. This change comes as people review new information. Tokyo’s primary inflation rate increased in February to 2.5% from 1.8% in January. This rise means prices are growing faster than before. It’s also higher than what the Central Bank of Japan aims for, which is 2%.

A significant figure from the Bank of Japan, Hajime Takata, suggests it’s time for the bank to think about changing its very relaxed money policies. He’s talking about moving away from negative interest rates and controlling how much bond yields can increase. This is a big deal because it could change how money flows in Japan’s economy.

USDJPY Analysis: Caution Before Change

Despite these discussions, BOJ’s head, Kazuo Ueda, urges patience. He believes it’s too soon to say if prices will keep rising at this rate. He emphasizes the importance of waiting for more data, especially about wages. Ueda is looking for signs of a cycle where wages and prices rise together, showing a healthy economy. But for now, he suggests watching and waiting before making any big moves.