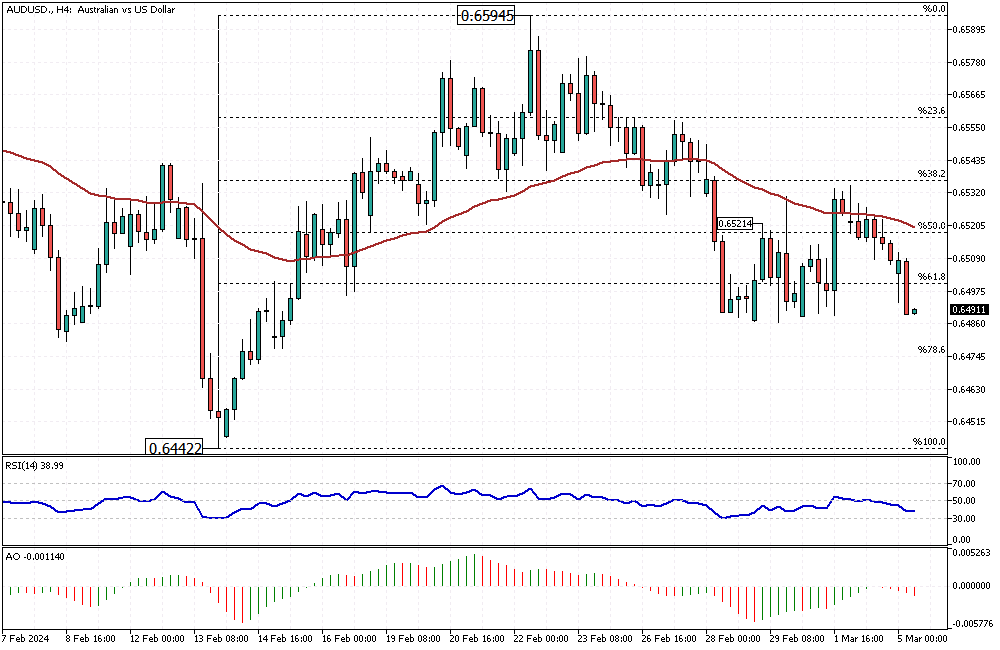

AUDUSD Analysis – March-5-2024

AUDUSD Analysis – The Australian dollar currently hovers around the $0.65 mark, reflecting investor caution. This sentiment is mainly due to the anticipation of several critical economic reports this week in Australia. These reports will illuminate the nation’s financial health and guide future monetary policy decisions. Notably, the spotlight is on the upcoming release of the fourth quarter gross domestic product (GDP) report, a significant indicator of economic performance.

AUDUSD Analysis: A Glimpse into Cost of Living

Recent data unveiled that Australia’s monthly Consumer Price Index (CPI) – a key measure of inflation and cost of living – remained steady at 3.4% in January. This figure aligns with December’s metrics and falls slightly below the anticipated 3.6%. This stabilization at a two-year low suggests a cooling in price pressures, an aspect keenly observed by economists and investors alike. It indicates a potentially shifting trend in the country’s inflationary landscape, which could have far-reaching effects on consumer spending and economic strategies.

Monetary Policy Deliberations: Reserve Bank of Australia’s Approach

The Reserve Bank of Australia’s (RBA) recent minutes revealed an intensive debate among policymakers regarding the trajectory of interest rates. The possibility of an increase was thoroughly examined in their February policy meeting.

However, the decision was to uphold the status quo regarding monetary settings. This cautious approach was chosen in light of emerging signs of moderating inflation. This decision underscores the RBA’s commitment to navigating economic challenges prudently while considering the broader implications of rate adjustments on the economy.