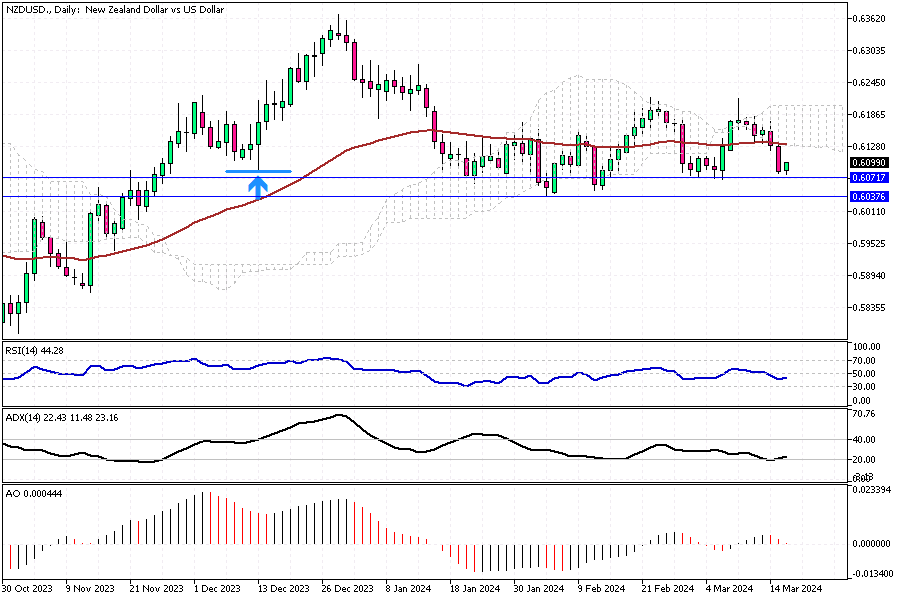

NZDUSD Analysis – March-18-2024

NZDUSD Analysis – The New Zealand dollar weakened, falling below the $0.61 mark, marking its lowest point in over a week. This change resulted from unexpectedly high US inflation figures, which cast doubts on the Federal Reserve’s future interest rate adjustments. The data indicated that both consumer and producer prices in the US for February surpassed forecasts, leading investors to reconsider their expectations for a rate decrease by the Fed in June.

RBNZ’s Stance Amid Global Financial Shifts

The Reserve Bank’s top economist, Paul Conway, closely monitored the situation in New Zealand. He speculated that the New Zealand dollar might regain strength if the US Federal Reserve decides to reduce rates towards the year’s end while New Zealand maintains higher domestic rates. Conway highlighted that such dynamics could potentially alleviate inflationary pressures in New Zealand.

Possible Adjustments in New Zealand’s Monetary Policy

Furthermore, Conway suggested that this financial landscape might prompt the Reserve Bank of New Zealand (RBNZ) to adjust its monetary policies earlier than expected. If the US proceeds with rate cuts and New Zealand’s interest rates remain high, it could reduce inflationary pressures.

Consequently, the RBNZ may need to consider easing its monetary settings sooner to maintain economic stability and growth. This situation underscores the intricate relationship between international economic policies and domestic financial health.