Canadian Dollar Decline Amid US Data, Oil Surge

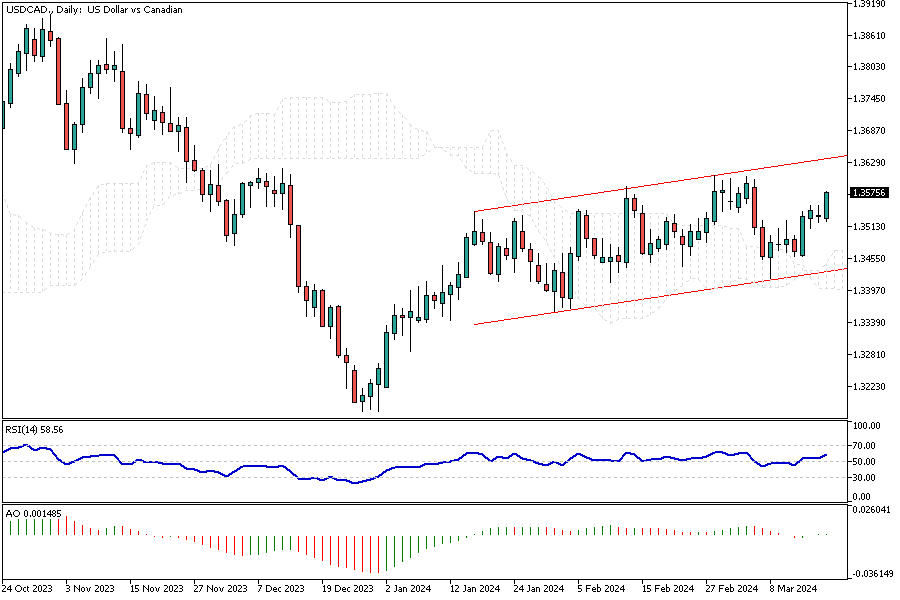

The Canadian dollar dipped below 1.35 against the US dollar, reaching its lowest weekly level. This came as the outlook darkened, with less likelihood of US Federal Reserve rate cuts after recent inflation reports, strengthening the US dollar. Despite expectations for a decrease, US producer prices in February stayed high, maintaining a 2.0% increase over the year against the forecasted 1.9%.

Moreover, fewer people filed for unemployment benefits than anticipated, with only 209,000 new claims for the week ending March 8. Consumer spending grew, with retail sales rising by 0.6%.

In Canada, the unemployment rate for February was as expected, increasing slightly to 5.8%, but the job market showed strength, adding an unexpected 42,000 jobs. However, the drop in the value of the Canadian dollar was somewhat offset by increased investment from abroad. This was due to reduced US oil stocks and rising tensions in the Middle East, which led to worries about oil supply and drove up prices.