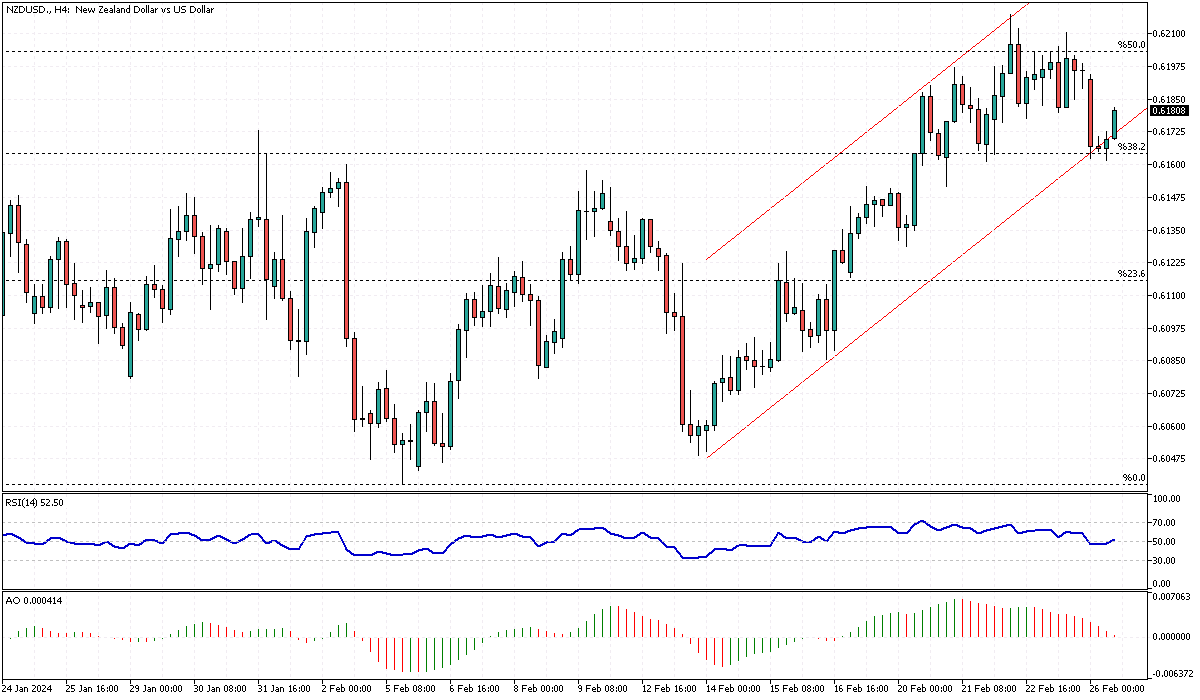

NZDUSD Analysis – February-26-2024

NZDUSD Analysis – The New Zealand dollar saw a significant decline, falling to $0.618, a noticeable drop from its recent peak exceeding one month. This decrease came as market participants adjusted their expectations regarding the Reserve Bank of New Zealand’s (RBNZ) monetary policy direction. Initially, there was speculation that the RBNZ might elevate interest rates further in their upcoming meeting.

However, the prevailing sentiment has shifted, with the majority anticipating the central bank will maintain the current rate of 5.5%. Despite this, a few market analysts still entertain the possibility of increasing rates, highlighting the unpredictability of these financial decisions.

NZDUSD RBNZ’sis: RB NZ’s Deliberation on Monetary Policy

The stance of the RBNZ has been a focal point for investors, especially following remarks from Governor Adrian Orr. Orr mentioned that the battle against core inflation is ongoing, implying that the bank’s efforts to stabilize prices are far from over. However, he also expressed concern over the potential negative impacts of excessive tightening of monetary policy, hinting at a cautious approach moving forward.

This balanced perspective has led to a recalibration of market expectations, with the likelihood of a rate hike by the RBNZ this month seeing a significant reduction. Furthermore, the anticipation for additional rate increases within the current year has diminished, with less than half of market participants betting on such an outcome.

Global Context Influencing Market Sentiments

The broader international economic environment is also critical in shaping market dynamics, significantly ahead of pivotal inflation data releases from leading economies such as the United States, Japan, and Australia. Investors eagerly await these figures, as they could significantly influence global market trends and monetary policy decisions worldwide.

The caution exhibited by markets reflects the interconnectedness of global economies and the impact of international financial indicators on local monetary policies. As the world awaits these critical economic indicators, the cautious stance adopted by the RBNZ appears to align with a broader trend of uncertainty and careful watchfulness prevalent in global financial markets.