Gold Prices Dip as Fed Holds Rates Steady

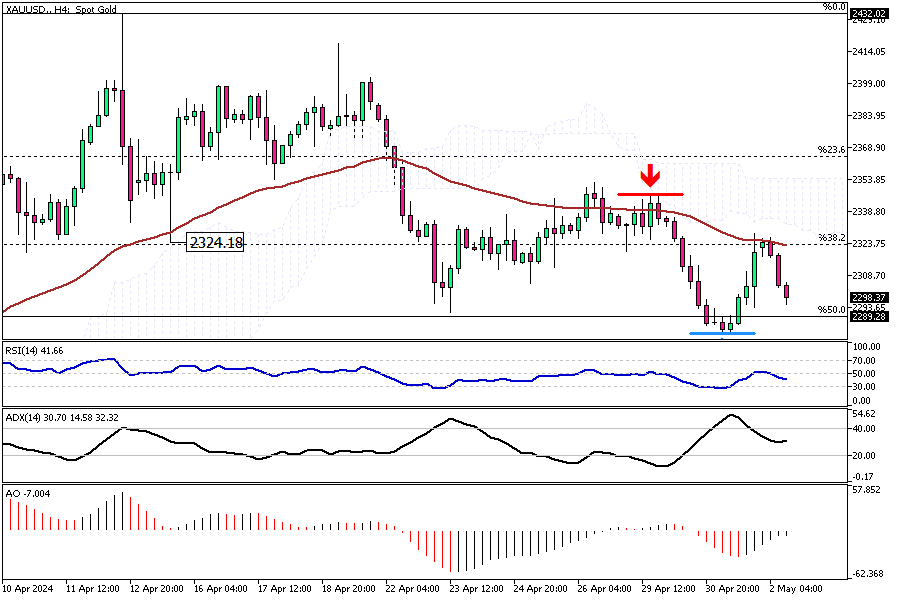

Gold prices have declined, falling below $2,298 per ounce and reaching a nearly four-week low. This downturn coincides with the latest financial decisions and global events influencing investor behavior.

Impact of Federal Reserve’s Decision

The Federal Reserve’s recent decision to maintain interest rates has significantly impacted gold prices. Despite expectations, the Fed’s Chair, Jerome Powell, announced that a rate increase was unlikely soon. However, Powell emphasized the need for solid evidence that inflation rates are falling. Although there’s still an expectation that inflation will decrease throughout the year, confidence in this projection has diminished.

Global Events and Market Reactions

In addition to domestic monetary policy, international affairs have also played a role in the changing prices of gold. With the easing of geopolitical tensions in the Middle East, mainly due to progress towards a ceasefire agreement between Israel and Hamas facilitated by Egypt, gold’s appeal as a safe-haven asset has lessened.

This decrease in demand, coupled with strong economic data and persistent inflation fears, has led investors to adjust their expectations regarding the Fed’s monetary policies.

Conclusion

As investors navigate through these complex factors, the trajectory of gold prices remains closely tied to both economic indicators and international developments. The interplay between Federal Reserve policies, inflation expectations, and global stability is crucial for market participants.