Silver Analysis – Fed Decisions Key for XAGUSD

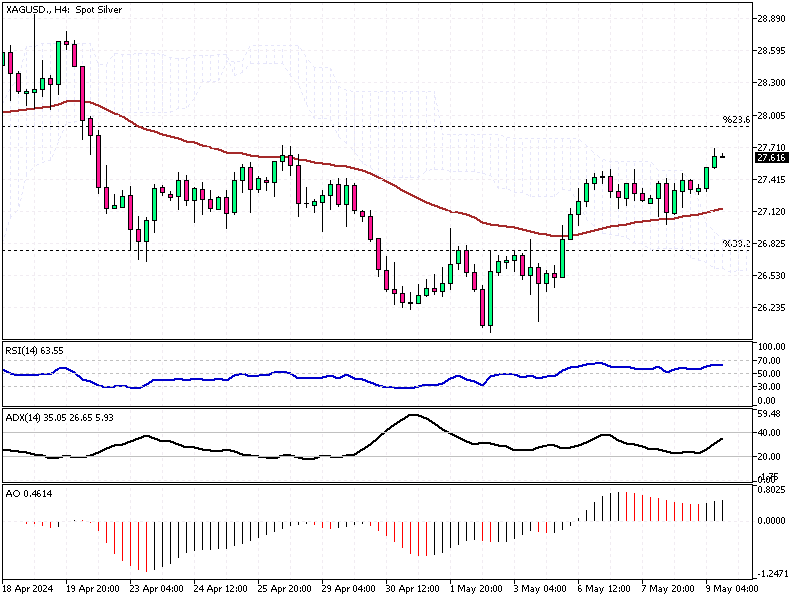

Silver prices have declined significantly to approximately $26.5 per ounce, reflecting a broader downtrend in precious metals. This shift is closely tied to recent economic data from the United States, which supports the Federal Reserve’s likelihood of maintaining higher interest rates for an extended period.

The employment cost index, a crucial gauge of wage growth for civilian workers, witnessed a 1.2% increase in the first quarter, surpassing expectations and the previous quarter’s growth. This acceleration underscores ongoing inflation concerns and suggests a narrower scope for the Fed to cut rates soon.

Silver Analysis – Fed Decisions Key for XAGUSD

As market expectations adjust to a delayed timeline for interest rate reductions, with predictions now pointing to November instead of September, investors are keenly awaiting the Federal Reserve’s upcoming meeting and the release of non-farm payroll data. These events are critical for further insights into the Fed’s rate trajectory.

Although higher interest rates typically reduce the attractiveness of non-yield-bearing assets like silver, the metal has still managed to secure over a 6% gain this month. This resilience is attributed to its dual appeal as both a safe-haven asset and a staple in various industrial applications.