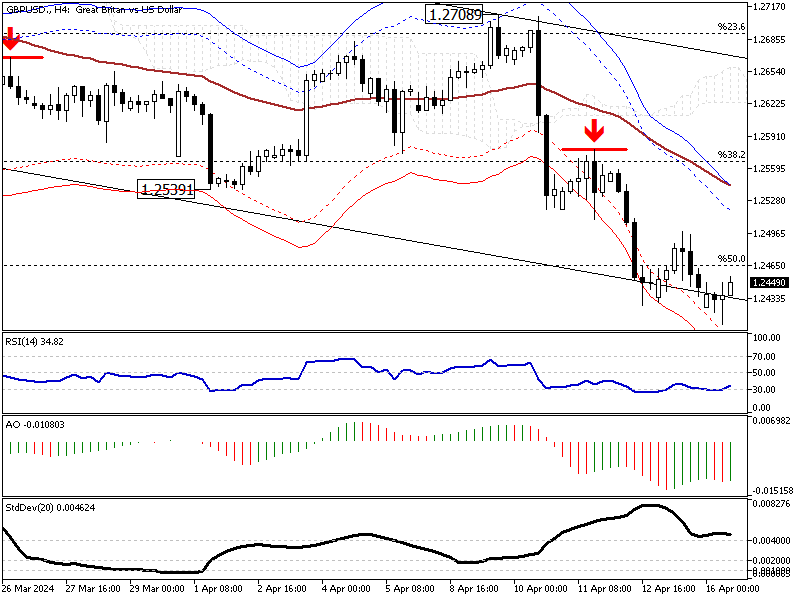

GBPUSD Falls to New Low – Hits $1.24

GBPUSD Analysis – Investors have had a lot to ponder, with the latest UK jobs report indicating a surprising uptick in unemployment. The figures rose to 4.2%, defying the expected stable rate of 4.0%. Simultaneously, the US dollar has held firm, backed by the widespread belief that the Federal Reserve will keep interest rates high for longer to combat inflation. This has naturally put downward pressure on the GBPUSD exchange rate.

Wage Trends and Interest Rate Expectations

Amid these unemployment figures, wage growth in the UK is also slowing down, adding to the bearish sentiment around the pound. Financial markets have adjusted their outlook on the central bank’s future moves. Notably, expectations for interest rate cuts by the Bank of England and the Federal Reserve have been recalibrated in light of solid inflation figures from the US.

The anticipated Bank Rate in the UK is expected to drop to around 4.75% by the end of 2024, a reduction from the current 5.25% and a less optimistic forecast than earlier predictions.

Policymaker Insights and Future Outlook

Last week, Bank of England policymaker Megan Greene highlighted the ongoing inflation challenges in the UK, suggesting that rate cuts should not be expected anytime soon. According to Greene, inflation in the UK poses a greater risk of persistence than in the US, urging a more cautious approach to monetary easing.

Summary

The GBPUSD exchange rate reflects ongoing global economic uncertainties and policy expectations. Significant fluctuations can be expected as the market absorbs and reacts to data from job markets and central bank policies. Investors and traders should closely monitor upcoming economic reports and central bank announcements for further clues on the pound’s direction versus the dollar.