AUDUSD Hits Low as US Data Impact Rates

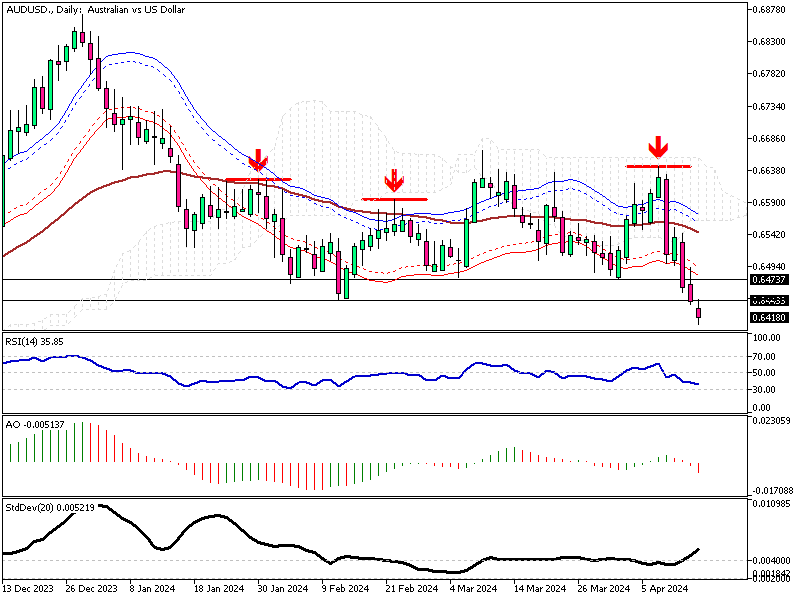

AUDUSD Analysis – The Australian dollar has dropped to its lowest point since mid-November at about $0.64. This decline is primarily due to robust U.S. retail sales data, which suggests the Federal Reserve might postpone any cuts in interest rates. Initially, the market anticipated the Fed would reduce rates in June, but now the expectation has shifted to September.

AUDUSD Hits Low as US Data Impact Rates

In contrast, the economic situation in Australia presents a mixed outlook that complicates predictions. Despite the Australian central bank hinting no further rate hikes, it remains cautious about cutting rates soon. This caution comes amidst robust employment figures and persistent inflation pressures.

The unemployment rate impressively dipped to 3.7% in February from 4.1% in January, marking the lowest rate since September. Meanwhile, inflation continues to hold steady at 3.4%.

Investors and analysts are closely watching these developments, as the interplay between U.S. economic strength and Australian domestic economic indicators will be crucial in determining the future movement of the AUDUSD exchange rate.