GBPUSD Analysis – UK Inflation Hits Lowest Since 2021

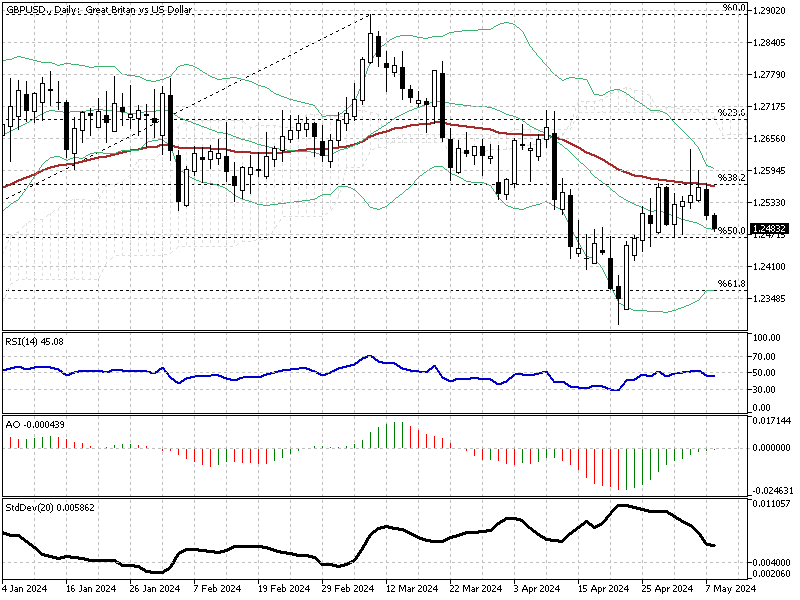

The British pound is currently trading around $1.25 (GBPUSD), reflecting a market attuned to shifts in monetary policy on both sides of the Atlantic. The U.S. Federal Reserve’s anticipated rate cuts have been moved forward to September from the expected November. This decision follows a recent U.S. jobs report that indicated weaker economic activity than initially forecast.

Forex traders and investors closely monitor these developments, significantly affecting currency valuations and trading strategies.

Bank of England’s Stance

While the U.S. is poised to ease interest rates, the Bank of England (BoE) is cautious. The BoE will likely keep interest rates steady at its forthcoming May meeting. However, market participants anticipate the first rate reduction in August, a month earlier than previous estimates.

This expectation adjustment comes after BoE Governor Andrew Bailey’s optimistic remarks regarding the trajectory of UK inflation, which is approaching the government’s 2% target.

Inflation and Economic Outlook

The inflation rate in the UK has shown a promising decline, reaching 3.2% in March 2024, the lowest since September 2021. This decrease from 3.4% in the preceding month marks a significant cooling from the peak of 11.2% observed in October 2022.

This downtrend in inflation suggests a stabilizing economic environment, potentially easing the cost of living pressures and improving consumer confidence in the UK.