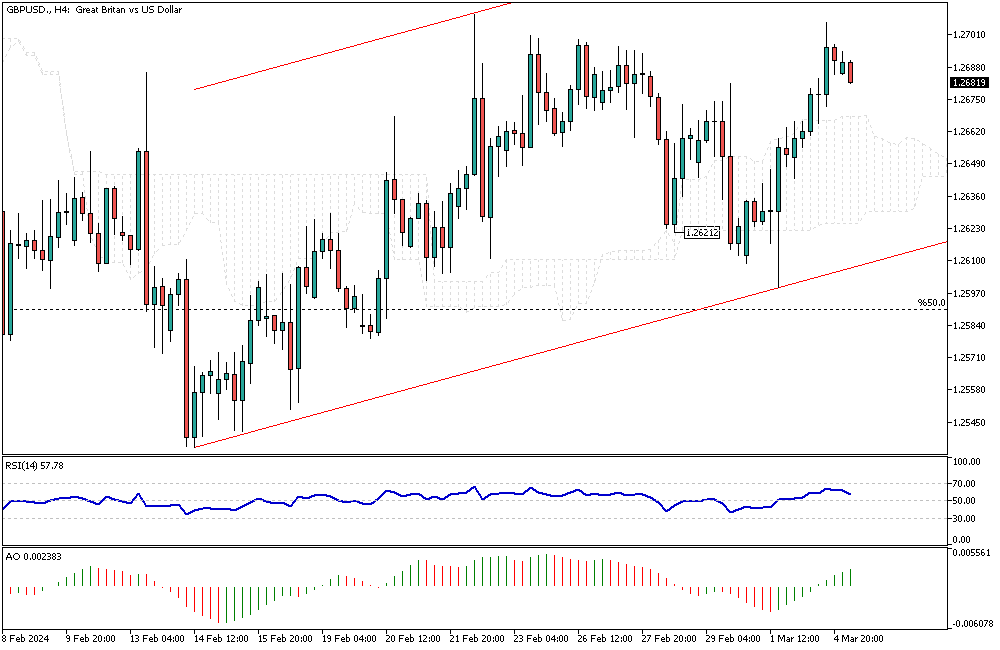

GBPUSD Analysis – March-5-2024

GBPUSD Analysis – The British pound has remained resilient, above $1.265. This strength is primarily attributed to positive developments within the UK housing sector. Recent data suggests a revival, with a notable increase in house prices signaling economic optimism. However, this positive trend exists alongside ongoing worries regarding inflation rates and the monetary policies of the Bank of England.

The landscape is complex, with economic indicators pulling in different directions, showcasing the delicate balance between growth and inflationary pressures.

Positive Shifts in UK Housing and Monetary Policy

In an uplifting turn for the UK economy, February saw a 1.2% rise in house prices compared to the previous year, as reported by Nationwide. This increase, the first in over twelve months, has been fueled by reduced borrowing costs and a slight alleviation in financial burdens for many families.

The Bank of England’s recent figures have also highlighted a significant surge in mortgage approvals and consumer borrowing. This unexpected growth is a positive sign, reflecting a potentially stabilizing economic environment and increasing consumer confidence.

GBPUSD Analysis: Upcoming Economic Announcements

The financial community is on edge, anticipating critical moves from the Bank of England, with speculations leaning towards a potential rate cut in August. This comes as the market also eyes possible similar adjustments by the Federal Reserve and the European Central Bank come June.

All eyes are now set on the forthcoming budget release by Finance Minister Jeremy Hunt, which is expected this Wednesday. This announcement is highly anticipated, as it could provide further direction on the UK’s fiscal and monetary path, significantly influencing investor decisions and market movements.