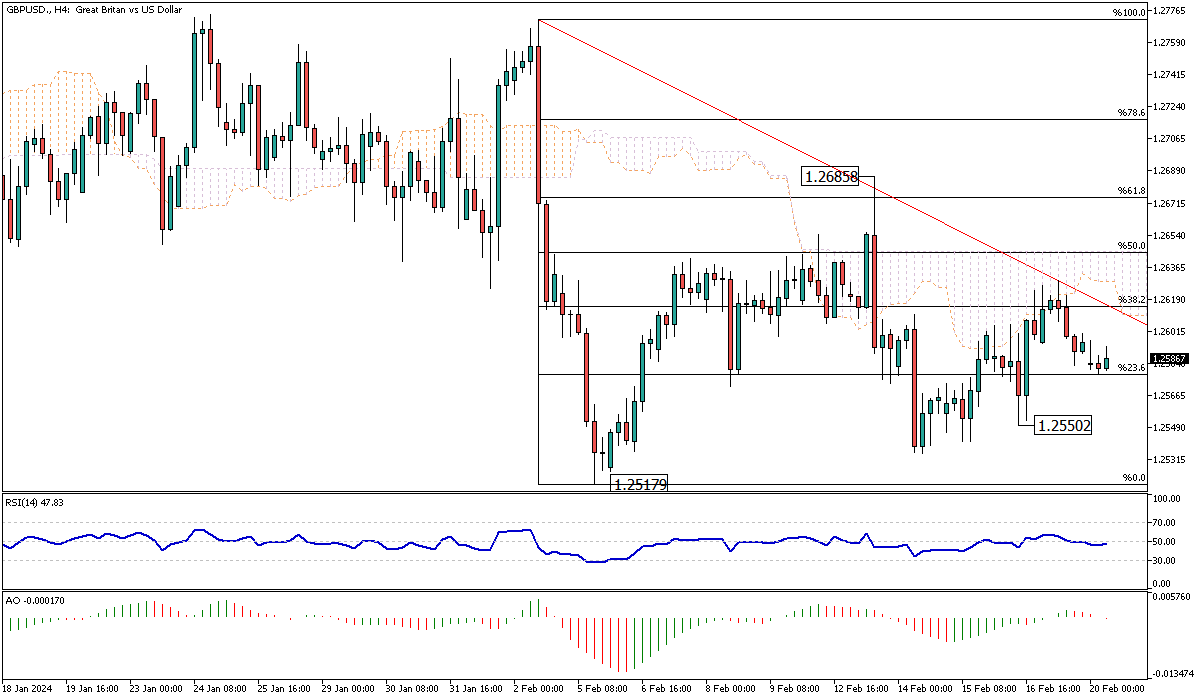

GBPUSD Analysis – February-20-2024

GBPUSD – The British pound has found a semblance of stability, hovering around the $1.26 mark as market participants evaluate economic reports and their implications on future monetary policies set by the Bank of England. Recent data have shown a surprising uptick in UK retail sales, which surged to their highest growth rate in almost three years during January, surpassing analyst predictions.

This development is significant as it reflects consumer confidence and spending behaviors, essential indicators of economic health. Such positive retail figures contrast with the preliminary data indicating a slight 0.3% shrinkage in the UK’s economy for the last quarter of 2023, which has been identified as the first technical recession since the pandemic’s peak in 2020.

GBPUSD Analysis: Economic Contrasts and Central Bank Insights

Despite the economy’s contraction in the latter part of 2023, the beginning of the new year brought some positive news. The inflation rate in January maintained its ground at 4%, defying the expected rise to 4.2% and falling slightly below the Bank of England’s forecast of 4.1%. This steadiness in price levels, coupled with the unexpected strength in wage growth during the fourth quarter, offers a nuanced picture of the UK’s economic landscape.

The consistent inflation rate, amidst other fluctuating indicators, suggests that the economy might be finding its footing after a tumultuous period. Governor Andrew Bailey of the Bank of England has acknowledged these mixed signals, noting the encouraging aspects of recent inflation data and hinting at the early signs of economic recovery.

Implications and Future Prospects

The economic milieu presents a complex puzzle for the Bank of England and market observers. The combination of strong retail sales, a contracting economy, and steady inflation rates forms a backdrop against which the central Bank’s future policy directions will be decided. Governor Bailey’s optimistic remarks on inflation and the budding signs of economic revival add layers to the narrative, suggesting that the Bank might adopt a cautious but potentially less restrictive monetary stance moving forward.

For investors and policymakers, deciphering these trends is crucial as they indicate the immediate fiscal responses and the long-term strategies to foster economic stability and growth. The evolving situation underscores the importance of adaptive policy measures and vigilant market analysis to navigate through the uncertainties of post-pandemic recovery.