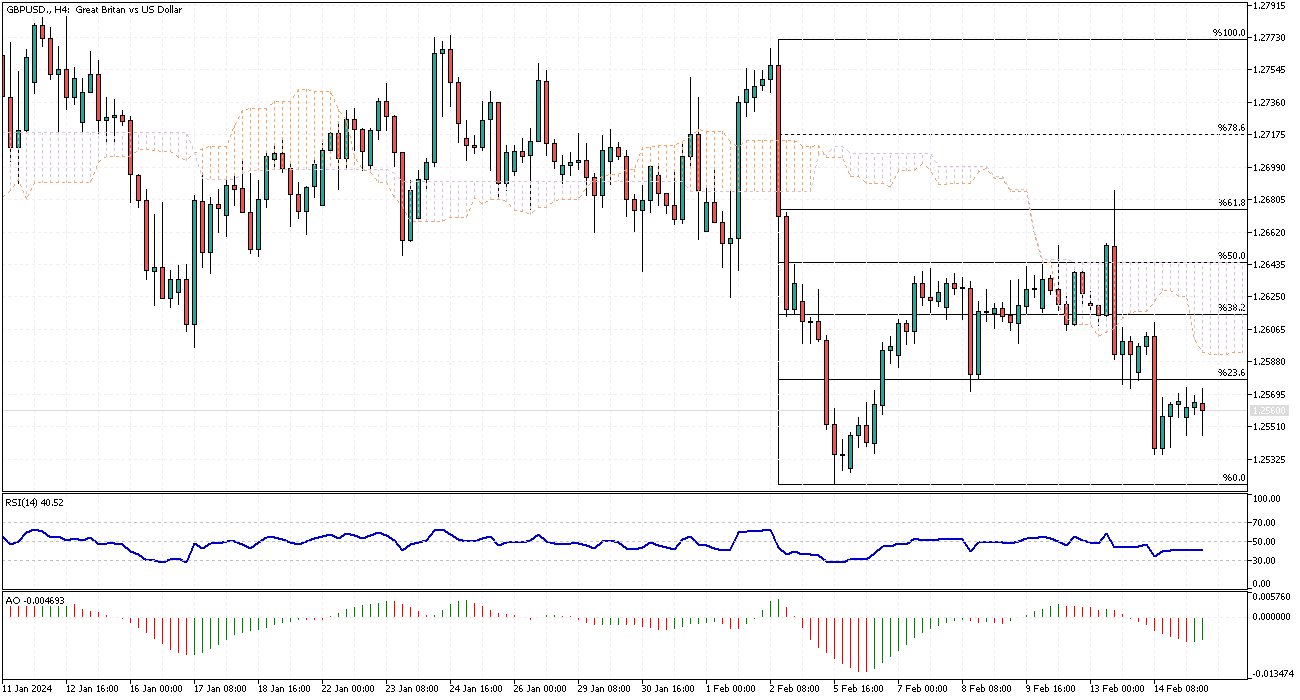

GBPUSD Analysis – February-15-2024

The British pound has seen a marginal dip, falling below the $1.26 mark in response to recent Consumer Price Index (CPI) data from the UK, which has somewhat alleviated concerns about inflation. The inflation rate for January remained constant at 4%, falling short of the anticipated 4.2% by analysts and the Bank of England’s prediction of a slight increase to 4.1%.

This unexpected steadiness in inflation rates offers a glimmer of hope that inflationary pressures might be starting to stabilize, providing cautious optimism for the economic outlook.

Labor Market Resilience and Interest Rate Speculations

Despite the tempered inflationary pressures, the UK’s labor market presents a contrasting picture of resilience, with wage growth decelerating less than initially predicted as the year 2023 drew to a close. This indicates a persistent strength in the labor market, suggesting it might require more time to cool off. Consequently, this could lead to the Bank of England postponing any reductions in interest rates.

This scenario underscores the delicate balance the central Bank must maintain between curbing inflation and supporting economic growth, especially as the country braces for the forthcoming GDP data. Expectations lean towards a 0.1% contraction in the fourth quarter, potentially signaling a technical recession, which adds another layer of complexity to the Bank’s monetary policy decisions.

Global Economic Dynamics and the Pound’s Outlook

The interplay between UK economic indicators and global financial trends, particularly the unexpectedly high US inflation rates, has further complicated the outlook for the British pound. The robust US inflation figures have dampened expectations for imminent Federal Reserve rate cuts in the upcoming March and May meetings, strengthening the US dollar. This dynamic has exerted additional downward pressure on the pound, highlighting the interconnected nature of global financial markets.

The evolving economic landscape, marked by these recent inflation and labor market developments, not only affects domestic policy considerations but also underscores the importance of international economic trends on currency valuations. As investors and policymakers navigate these uncertain times, the intricate balance of domestic economic health and global financial forces will be crucial in shaping the pound’s trajectory in the near term.