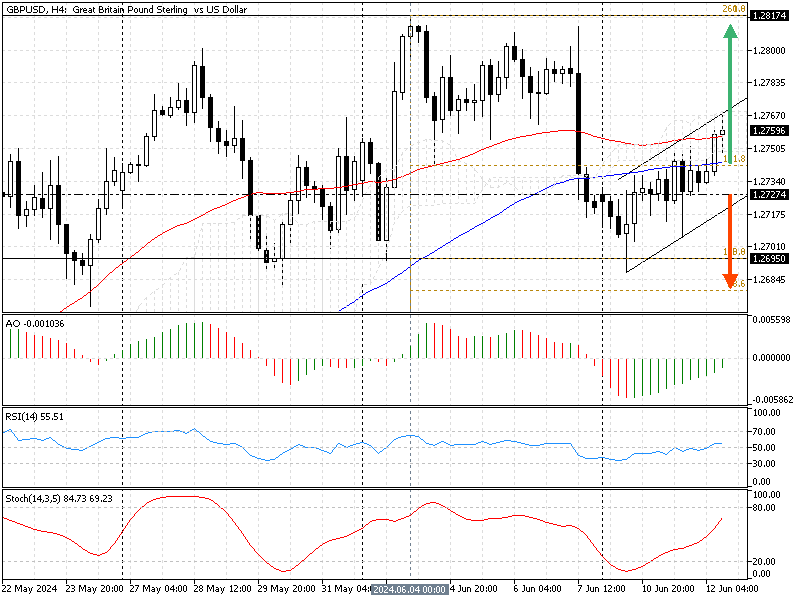

GBPUSD Analysis – 13-June-2024

GBP/USD—The British pound has fluctuated but remains above $1.28, marking its highest point in three months. This rise can be attributed to a significant drop in the value of the US dollar, influenced by slower-than-expected inflation in the United States.

The Federal Reserve decided to keep interest rates steady, which was anticipated by the market. However, the Fed indicated plans for only one rate cut this year and four next year, falling short of market expectations for 2024.

GBPUSD Analysis – 13-June-2024

UK Interest Rates Likely to Hold Steady

The Bank of England is also expected to maintain its current interest rates next week in the United Kingdom. Traders are predicting a potential rate cut in either August or September. Recent economic data from the UK shows that the economy has stalled in April, aligning with forecasts. However, industrial production and construction output have significantly underperformed expectations.

Wage Growth Up as Job Market Falters

Labor market data presents a mixed picture: wage growth remains strong, typically a sign of economic health. However, the unemployment rate has unexpectedly risen to 4.4%, the highest level since September 2021, and the number of job vacancies continues to decline. This indicates that while wages are up, the job market may weaken.

Understanding these trends is crucial for making informed financial decisions. The interplay between US and UK economic policies and performance highlights the importance of staying informed about local and international economic developments.