GBPUSD Analysis – Investors Await US CPI and British GDP Data

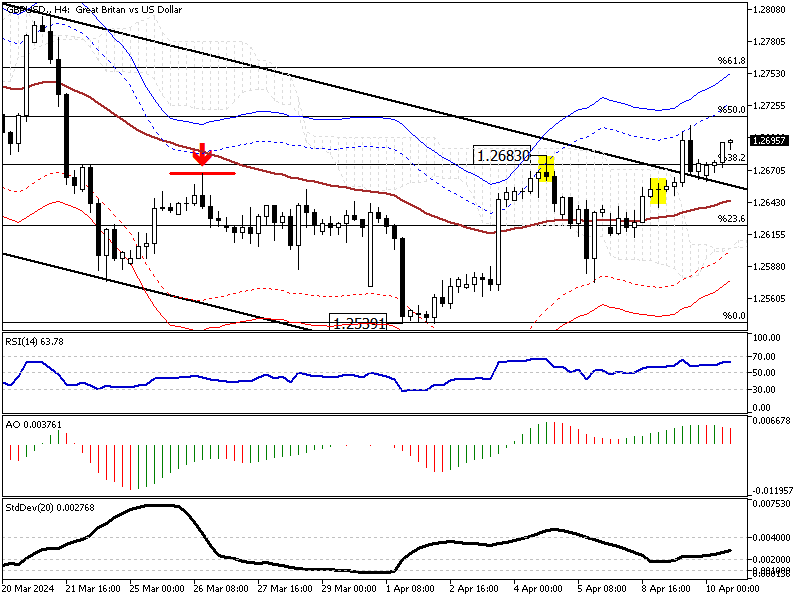

GBPUSD Analysis – The British pound is trading at around $1.265 as investors worldwide look forward to the US CPI report for March, which is expected this Wednesday. This report could suggest when the Federal Reserve might start lowering interest rates. Also, people are watching Britain’s GDP numbers, which are set to be released this Friday.

A recent report from the Recruitment and Employment Confederation (REC) on Monday showed that the salary growth for permanent employees in March was the slowest in over three years, and spending on temporary staff saw its most significant drop since July 2020.

The financial markets are anticipating roughly 70 basis points in rate cuts in the UK for this year, especially since two of the Bank of England’s (BoE) previously more aggressive members recently retracted their push for higher rates at the last meeting.