EURUSD Technical Analysis: Downtrend in Detail

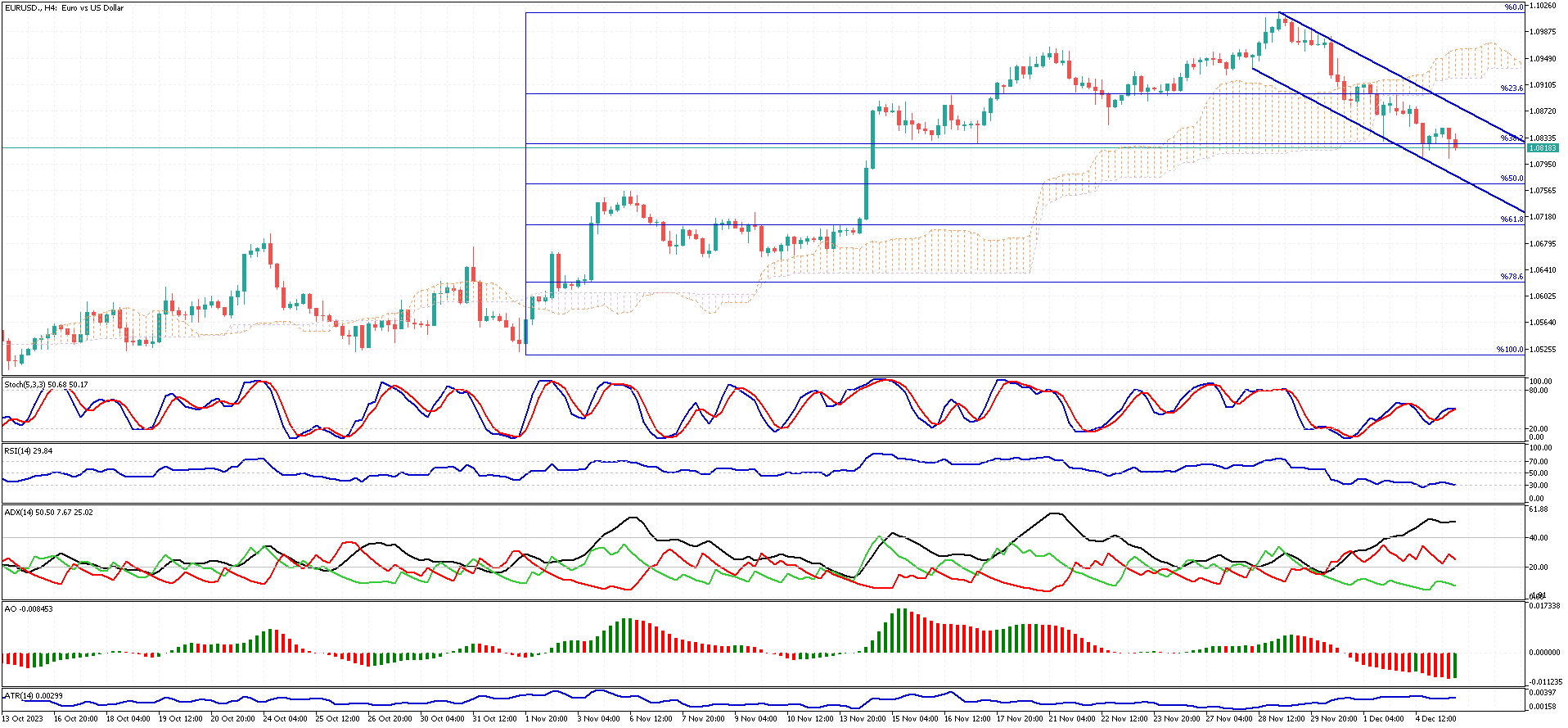

EURUSD Technical Analysis – In today’s trading session, the pair continued its downtrend, following a brief period of consolidation near the 38.2% Fibonacci retracement level. This movement is part of a larger bearish trend that has been observable in recent times. The ADX indicator, currently hovering above the 40 line, clearly demonstrates that the market is exhibiting a strong trending behavior.

Given this scenario, we anticipate that the EURUSD pair will experience increased bearish momentum. The next critical target for the pair appears to be the 50% Fibonacci support level. This level is significant as it may either provide a strong support, potentially leading to a reversal, or, if broken, could signal a further decline. This makes the 50% Fibonacci level a key area of interest for traders and analysts closely watching the pair’s movements.

EURUSD Technical Analysis – 4H Chart

Euro’s Decline on Schnabel’s Dovish ECB Comments

The euro is approaching a three-week low, moving closer to the $1.08 mark. This recent drop, the most significant since mid-November, comes in the wake of comments from ECB member Isabel Schnabel. Her dovish stance has fueled speculation that the European Central Bank might reduce interest rates sooner than anticipated.

Schnabel, known for her conservative views, spoke to Reuters and suggested that further interest rate hikes seemed “rather unlikely.” This statement follows the latest CPI report, which revealed a decrease in the Euro Area’s inflation rate to 2.4% in November. This rate is the lowest in over two years and is below the expected 2.7%. The core inflation rate also saw a decline, reaching 3.6% against the forecasted 3.9%.