GBPUSD Analysis – December-6-2023

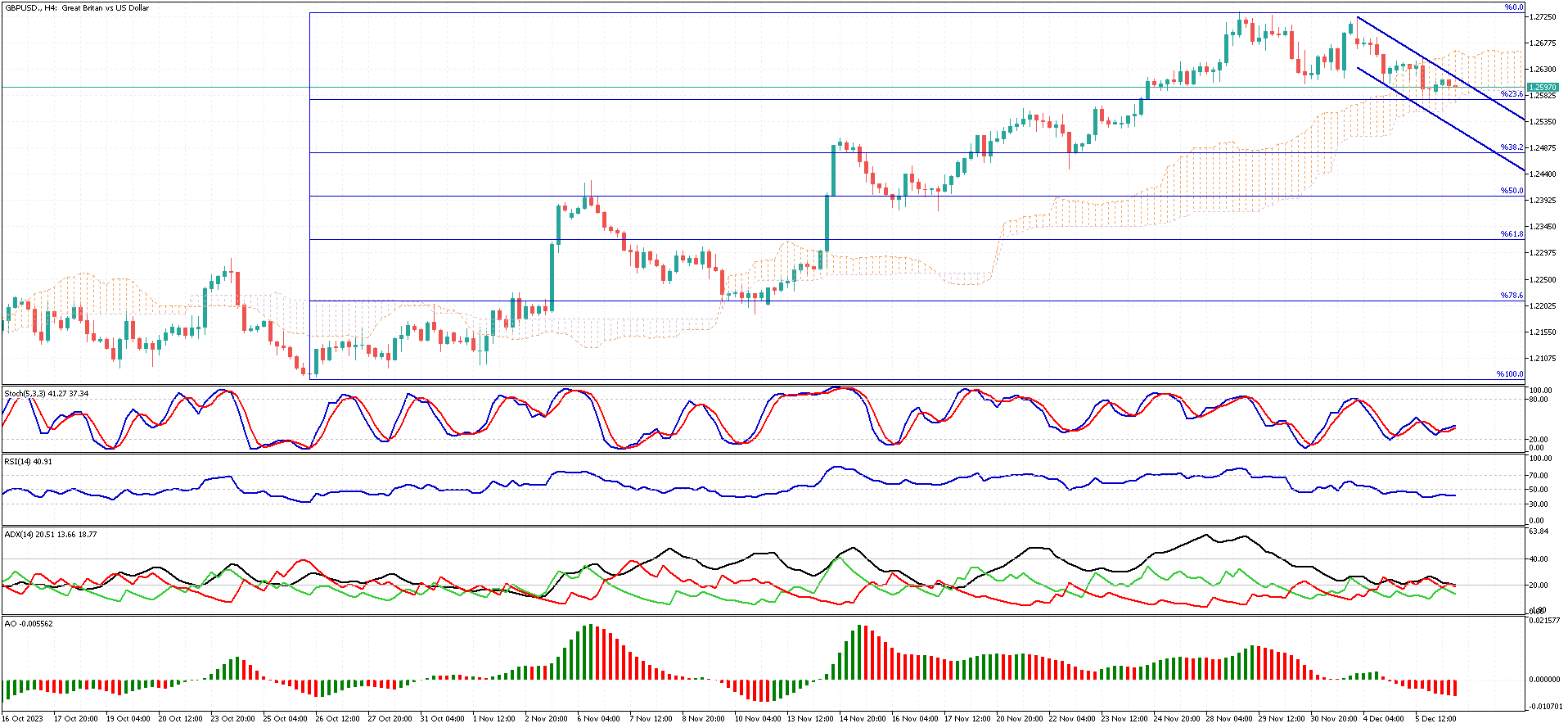

Currently, the currency pair is exhibiting a ranging pattern within the Ichimoku cloud, indicating a phase of price stabilization. This stabilization is particularly notable above the 23.6% Fibonacci retracement level, which is critical in assessing the pair’s momentum. For the GBPUSD pair to maintain and extend its bullish trend, an essential movement is required: it must decisively cross above the bearish flag formation that has been observed.

This crossing is crucial as it signifies a potential upward trend continuation. However, failure to achieve this breakthrough is significant. If the pair does not successfully navigate past this bearish flag, it could lead to a notable decline. Such a decline might extend to the 38.2% Fibonacci retracement level, a scenario that traders and analysts closely monitor.

GBPUSD Analysis – 4H Chart

UK Construction Sees Major Downturn in November

Bloomberg – In the UK, November 2023 witnessed a significant downturn in construction activity. The S&P Global/CIPS UK Construction PMI, a vital indicator of the sector’s health, registered only 45.5, a marginal dip from October’s 45.6. This figure, failing to meet the anticipated 46.3, signals one of the steepest declines in the industry since May 2020. The most pronounced slump was seen in house building, primarily due to reduced investments in residential projects and broader market challenges. Downturns closely followed this in civil engineering and commercial construction.

A continued trend in the industry was the reduction of new orders and purchasing of inputs, a clear indicator of declining confidence and activity in the sector. However, Vendor lead times have decreased for the ninth month in a row—a silver lining, perhaps, in an otherwise dim outlook. In terms of costs, the industry experienced the most substantial easing in input prices since July 2009, which could be a response to the overall slowdown.

Looking forward, there’s a glimmer of optimism. Expectations for business activities in the year ahead have seen a slight uplift from the low levels of October. However, these hopes are still considerably muted compared to the more robust first half 2023.