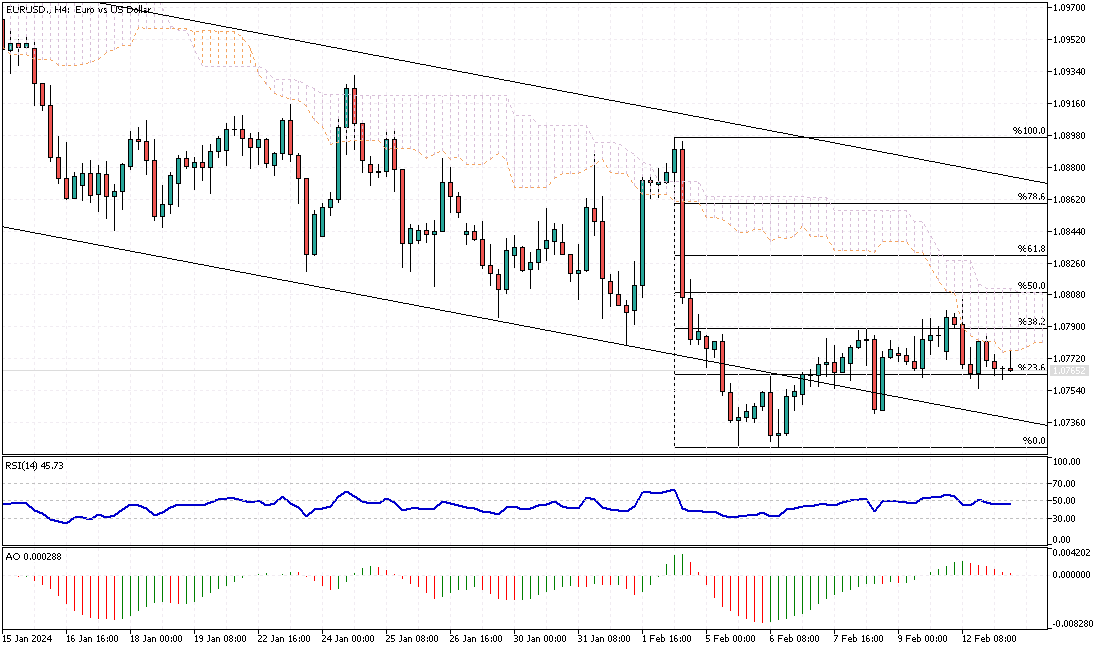

EURUSD Analysis – February-13-2024

EURUSD Analysis – Despite dropping to a low of $1.072 on February 5th, its lowest in over two months, the euro managed to stabilize around $1.077. This shift came as investors started doubting the European Central Bank’s (ECB) willingness to reduce interest rates soon, influenced by cautious comments from top ECB officials. They signaled a hesitation to ease monetary policy quickly, urging patience and a need for clear signs that inflation is returning to the desired 2% mark.

EURUSD Analysis: ECB’s Cautious Stance on Rate Cuts

Once anticipating an early rate cut by the ECB, financial markets are now less sure, seeing less than a 50% likelihood of a reduction happening by April. This change in perspective follows statements from key ECB figures, including chief economist Philip Lane and Belgian central bank governor Pierre Wunsch. They stressed the importance of solid proof that inflation aligns with their target before proceeding with rate reductions.

Additionally, ECB member Robert Holzmann suggested maintaining current rates throughout the year or considering a cut only towards the end.

EURUSD Analysis: Global Monetary Policy

The US dollar gained strength from positive jobless claims data, suggesting a robust labor market. This information points to the Federal Reserve possibly adopting a cautious stance on altering its monetary policy. The contrast between the euro’s situation, affected by the ECB’s hesitant approach to rate cuts, and the dollar’s boost from solid employment figures highlights the complex interplay of economic indicators and central bank policies.

This backdrop creates a nuanced environment for investors navigating the global financial landscape, emphasizing the importance of monitoring major bank signals and economic trends to make informed decisions.