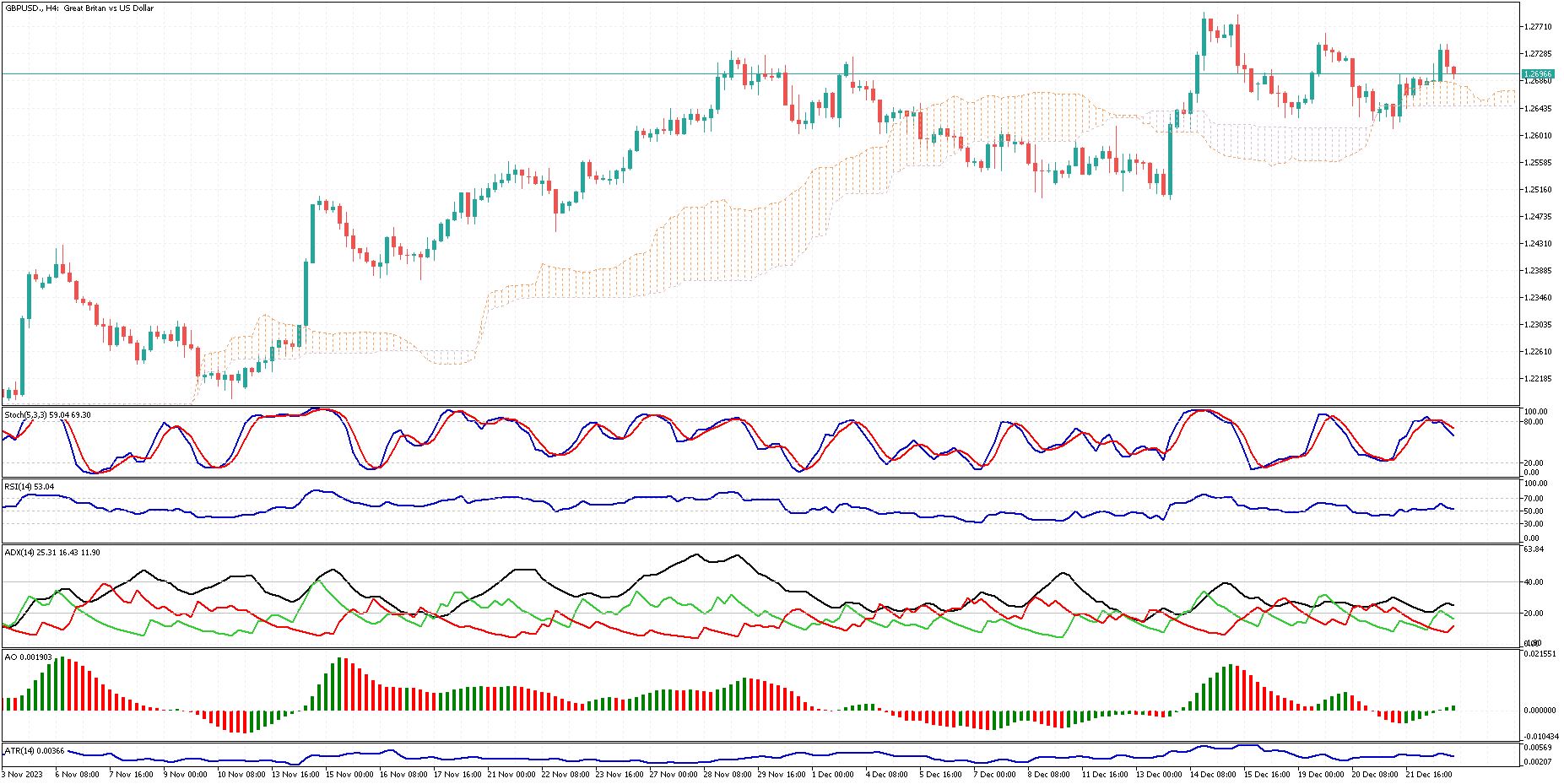

GBPUSD Analysis – December-25-2023

The UK’s currency, the Pound, has risen above $1.27. This comes as investors look at new data and consider what might happen with monetary policy. The economy in the UK shrank in Q3, and Q2 numbers were also adjusted to show a decrease. This makes a recession more likely. On the other hand, retail sales in November were better than predicted.

The CPI report showed that inflation in the UK slowed to 3.8%, less than the forecasted 4.4%. The core inflation rate also fell to 5.1%, less than the predicted 5.6%. As a result, traders are expecting the Bank of England to lower interest rates next year. They’re predicting a total cut of 143 basis points. This means they’re fully expecting five quarter-point cuts each, and there’s a 70% chance of a sixth cut. However, BOE Governor Andrew Bailey has been saying that rates should stay high longer. Inflation is still nearly twice the BOE’s target of 2% and is the highest of any Group of Seven countries.