Canada’s Central Bank Maintains Rate at 5%

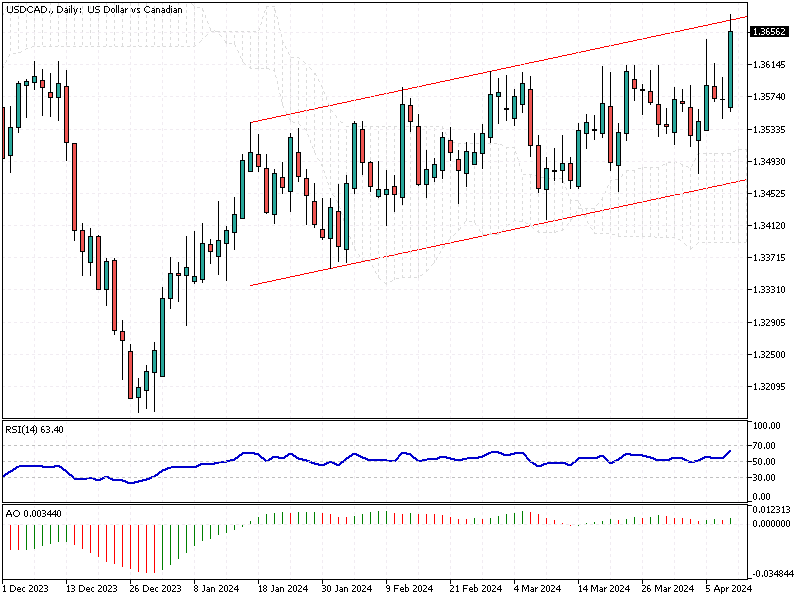

USDCAD Analysis — During its April session, the Bank of Canada decided to keep the overnight rate steady at 5%, as most investors had predicted. The bank also mentioned its plans to continue shrinking its balance sheet.

Officials emphasized the ongoing higher risk of inflation. They observed that the cost of various goods and services has gone down since their last gathering. However, they pointed out that the current unpredictable economic conditions and the unexpected rise in commodity prices, such as oil, make it harder to reduce inflation smoothly.

Therefore, the Bank of Canada anticipates that inflation will hover around 3% in the early part of this year and aims to bring it down to 2% by 2025. Additionally, recent indicators of global solid economic health have led officials to forecast a more robust local economy. They expect the GDP to grow by 1.5% this year and by 2.2% in 2025.