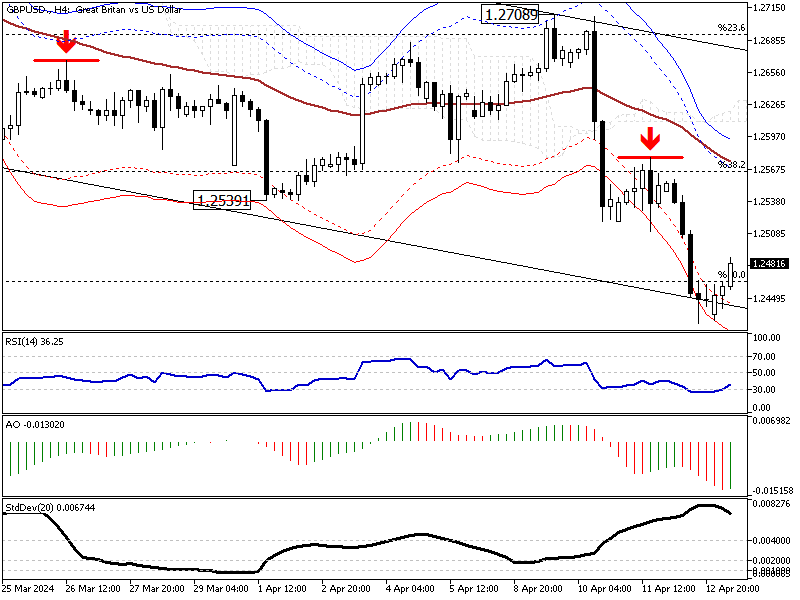

GBPUSD Facing Downward Pressure Amid Global Tensions

The GBPUSD exchange rate has recently experienced a significant downturn, with the British pound dropping below the $1.25 level for the first time since November. This decline is largely driven by increased demand for the US dollar and shifting interest rate expectations in the US and the UK.

Factors Influencing the GBPUSD

Rising geopolitical tensions have led to a surge in dollar-buying as investors seek the safety of the US currency. This shift in market sentiment has directly impacted the GBPUSD rate, contributing to the pound’s decline.

US Economic Indicators and Fed’s Rate Decisions

The US economy showed a stronger-than-expected inflation rate, influencing the Federal Reserve’s monetary policy outlook. Initially, the market anticipated the first Federal Reserve interest rate cut as early as September. However, the robust inflation data suggest that high rates could persist longer than expected, supporting the dollar’s strength against the pound.

Adjusted UK Rate Cut Forecasts

In the UK, the scenario is slightly different. Traders have adjusted their forecasts concerning the Bank of England’s interest rate cuts. The Bank Rate is now expected to decline to around 4.75% by the end of 2024, a shift from the previous forecast of a drop to 4.5% by December 2024. This adjustment indicates a less aggressive approach to cutting rates, which may weaken the pound further.

Comments from UK Policymakers

Adding to the downward pressure on the pound, Policymaker Megan Greene highlighted concerns over persistent inflation in the UK. She suggested that rate cuts should be more distant than anticipated, acknowledging the ongoing inflation threats exceeding US inflation.

Market Implications and Strategic Insights

Given the current economic indicators and central bank policies, GBPUSD will likely remain under pressure soon. Investors and traders should monitor upcoming economic data releases from the US and the UK, as these will provide further insights into future monetary policies and their potential impacts on the exchange rate.

Additionally, geopolitical developments should be closely watched, as any escalation could further strengthen the US dollar, thereby exerting additional downward pressure on GBPUSD.

Conclusion

The GBPUSD exchange rate faces significant headwinds stemming from stronger economic indicators in the US, revised rate cut expectations in the UK, and ongoing global uncertainties. Stakeholders in the forex market should remain vigilant, considering the dynamic global economic environment and its potential effects on currency movements.