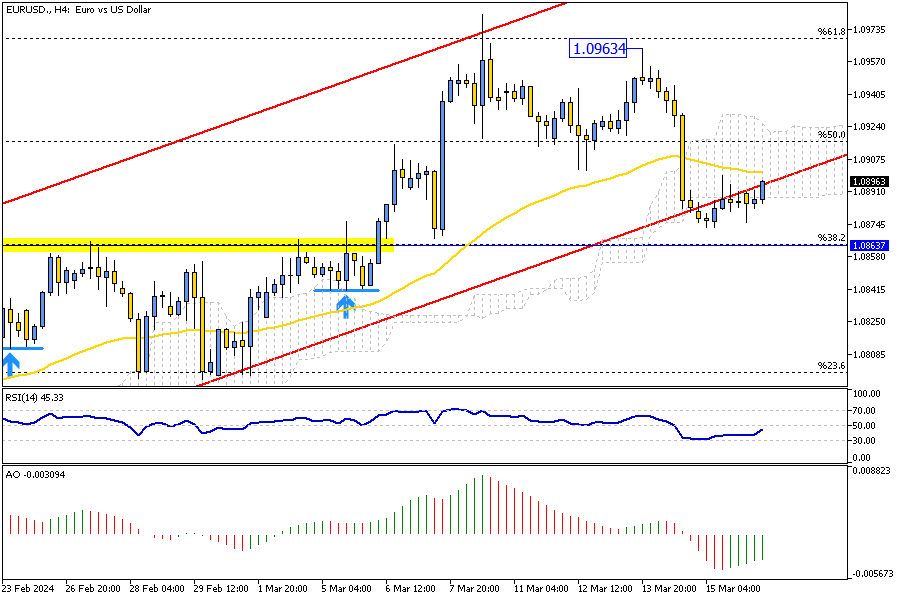

EURUSD Analysis – March-18-2024

EURUSD Analysis — The Euro is trading just below the $1.09 mark. This minor fluctuation comes as European Central Bank (ECB) officials continue to exhibit a cautious, or “dovish,” approach towards the economy. Meanwhile, the spotlight has shifted to the US dollar.

This shift was triggered by the release of unexpectedly high inflation figures in the US, which reduced the likelihood of the Federal Reserve lowering interest rates in June. This dynamic interplay between the Euro and the dollar highlights the constant adjustments in the global financial markets, driven by economic indicators and central bank policies.

ECB’s Stance on Interest Rates: A Delicate Balance

In a recent statement, ECB council member Olli Rehn noted that the central bank began considering potential rate decreases during their March meeting. This disclosure aligns with previous comments from different ECB officials, who have hinted at the possibility of a rate cut by late spring or early summer.

This gradual shift towards a more accommodative monetary policy reflects the central bank’s response to changing economic conditions. By potentially lowering rates, the ECB aims to stimulate economic activity, although they have maintained borrowing costs at historically high levels for the time being.

Preparing for Change: ECB’s Future Directions

Despite holding borrowing costs steady, the ECB has hinted at an impending adjustment. At the start of the month, the bank hinted at its readiness to lower interest rates for the first time after adjusting its inflation forecasts downward for 2024 and 2025. This strategic move indicates the ECB’s proactive approach to managing inflation while fostering economic growth.

By signaling potential rate cuts, the ECB is preparing markets for future monetary policy shifts, underscoring its commitment to adapt to evolving economic landscapes and ensure stability within the eurozone.