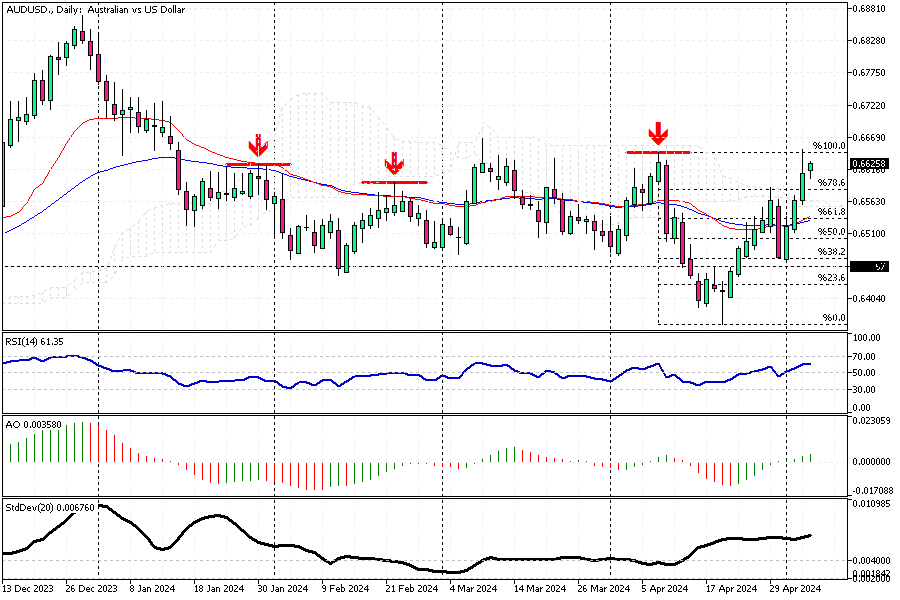

AUDUSD Strength Amid RBA Decision

The Australian dollar (AUD) is trading strong, maintaining a position above $0.66 and near its highest in two months. This movement comes as the market anticipates the upcoming policy decision from the Reserve Bank of Australia (RBA).

Reserve Bank’s Upcoming Decision

Investors are gearing up for the RBA’s imminent policy announcement, with expectations set on maintaining the current interest rates. However, there’s a twist in market sentiment; traders predict a potentially more hawkish stance from the central bank. This speculation is fueled by Australia’s recent inflation figures, which exceeded market forecasts despite a consecutive slowdown.

Inflation and External Factors

Australia’s inflation eased to 3.6% in the first quarter, down from 4.1%, marking the fifth consecutive quarterly decline. However, it still surpassed the expected 3.4%. Moreover, the monthly Consumer Price Index (CPI) saw an unexpected rise to 3.5% in March, up from February’s 3.4%, challenging the stability predictions.

On the international front, the AUD is further buoyed by a weakening US dollar, spurred by anticipations of potential rate cuts by the Federal Reserve within the year.

Conclusion and Investment Insights

For forex traders and investors, the current dynamics of the AUD present both opportunities and areas for caution. Monitoring the RBA’s policy direction will be crucial, as any shift towards a hawkish stance could further strengthen the AUD. Moreover, global influences, particularly the monetary policies of the US Federal Reserve, will play a significant role in shaping the AUD’s trajectory in the coming months.