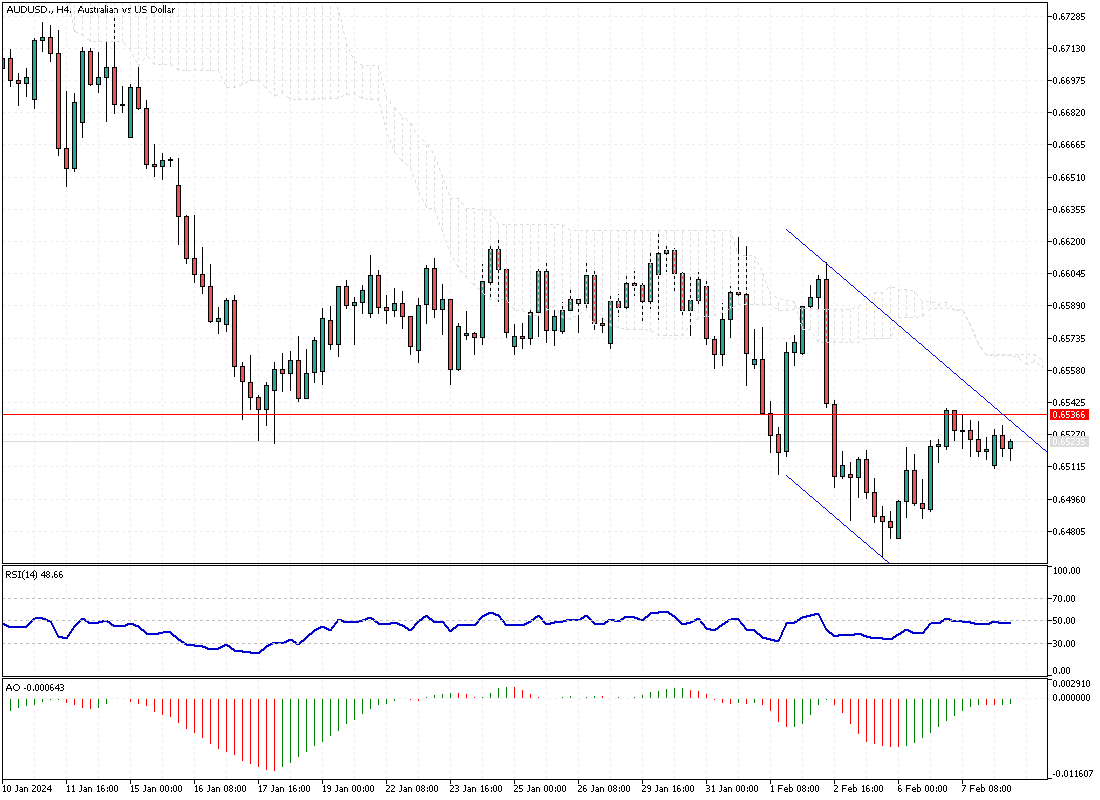

AUDUSD Analysis – February-8-2024

AUDUSD – The Australian dollar has made a noticeable recovery, pushing past the $0.65 mark. This comes after a period of decline, hitting an 11-week low. The bounce back was triggered by the Reserve Bank of Australia’s (RBA) decision to keep interest rates unchanged, a move that many had anticipated.

However, the RBA threw in a curveball with a cautionary note about the potential for future interest rate increases, pointing to the stubbornly high inflation as the main culprit. This announcement has highlighted the delicate balance the RBA is trying to maintain between stimulating economic growth and controlling inflation.

AUDUSD Analysis: Inflation Trends and Indicators

Inflation, a critical factor for economic health, showed signs of slowing down in the last quarter, a development the RBA found somewhat relieving yet remained cautious about the future. The inflation rate’s dip to 4.1% from a previous high of 5.4% indicates progress, yet the journey back to the RBA’s comfort zone of 2-3% is still uncertain.

Notably, the consumer price index’s growth pace has decelerated, missing economists’ predictions and signaling a complex economic landscape. Despite being a positive sign, this slowdown in inflation doesn’t remove the possibility of further monetary tightening to ensure long-term stability.

AUDUSD: External Influences and Future Outlook

Amidst its internal challenges, the Australian dollar’s strength is also being tested by international forces, particularly by the US dollar’s surge. Strong economic indicators from the United States and the Federal Reserve’s firm stance on interest rates have lessened the likelihood of rate reductions.

This external pressure adds another layer of complexity to Australia’s economic outlook. As the RBA navigates through these turbulent waters, the potential for further rate hikes looms, underscoring the ongoing battle against inflation and its impact on the global economy. The Australian economy’s resilience and the RBA’s strategic decisions will be crucial in shaping the future trajectory of the Australian dollar.