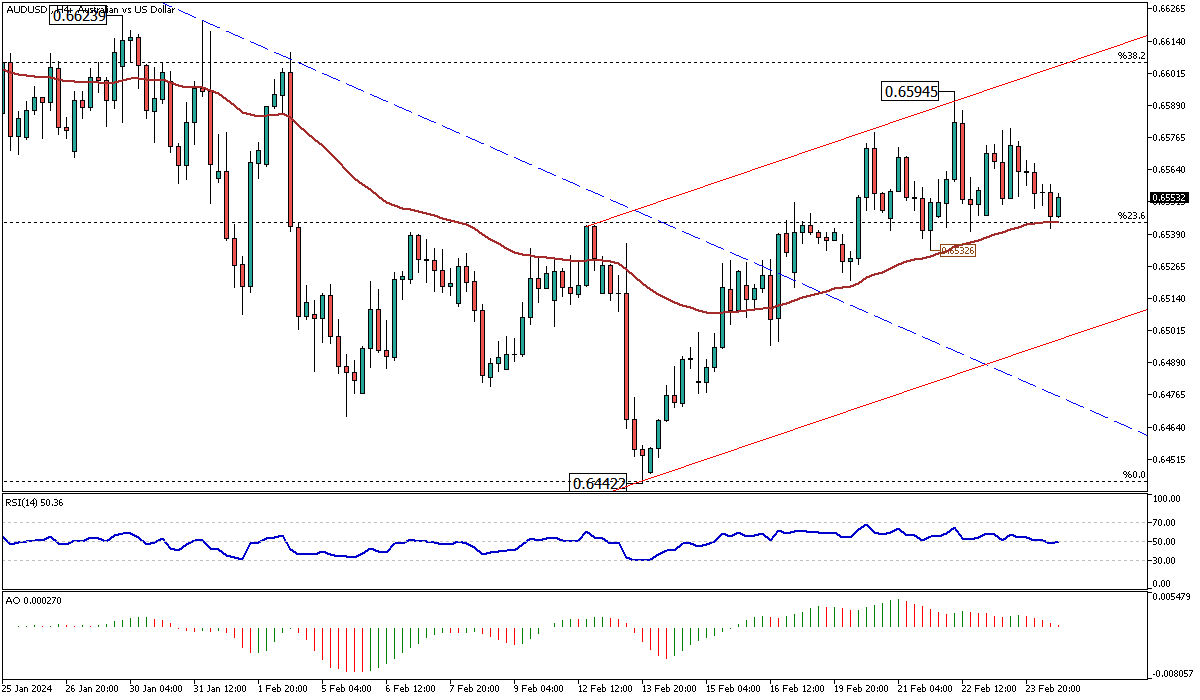

AUDUSD Analysis – February-26-2024

AUDUSD Analysis – The value of the Australian dollar has recently dipped below $0.656, retreating from its highest position in three weeks. This shift comes as market participants adopt a more conservative stance in anticipation of imminent local inflation data, which could significantly impact the Reserve Bank of Australia’s (RBA) forthcoming decisions on monetary policy.

As traders and investors await these key figures, there’s a palpable sense of caution, reflecting the potential implications for future interest rate movements.

AUDUSD Analysis: Anticipated Inflation Developments

In the current economic climate, there’s a general expectation that Australia’s inflation rate might slightly rise to 3.5% in January, up from 3.4% recorded in December. This anticipated increase is modest but essential, as an inflation rate surpassing expectations could lead to renewed conjecture about the RBA potentially implementing another increment in interest rates.

Such speculation stems from recent economic patterns and the central bank’s reactions to inflationary pressures, highlighting the intricate balance between fostering economic growth and controlling inflation.

Reserve Bank’s Monetary Stance

The RBA’s meeting minutes shed light on the central bank’s current monetary stance. During this session, the decision-makers thoroughly discussed the possibility of further rate increases at the February meeting. However, they chose to keep the rates steady, citing emerging signs of inflation easing as a primary reason.

This decision underscores the RBA’s cautious approach, as they seek more definitive evidence that inflation is on a downward trajectory towards their target range before considering any additional increases in interest rates. This strategic patience illustrates the bank’s commitment to ensuring inflationary pressures do not derail the broader economic stability and growth.