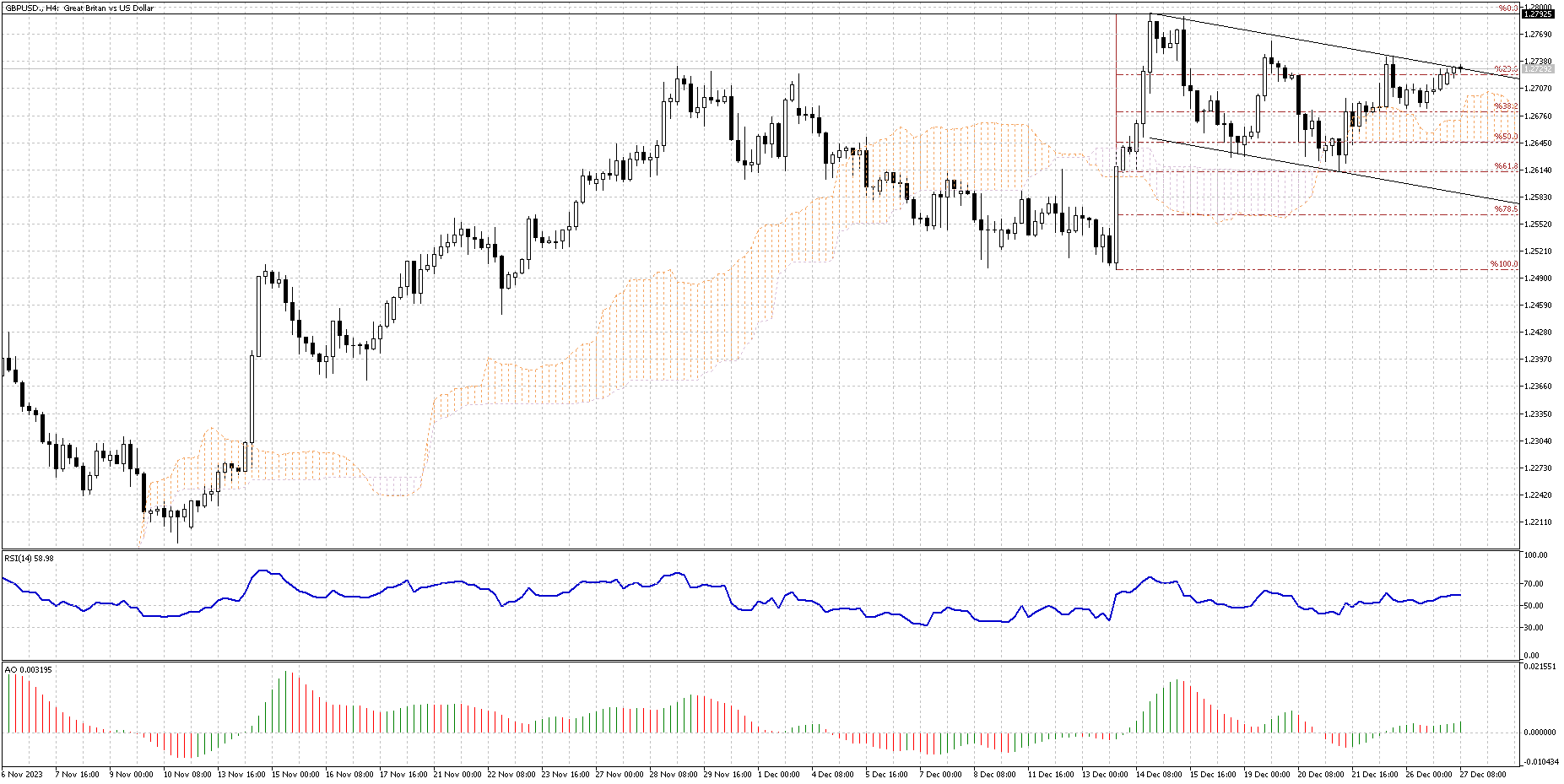

GBPUSD Analysis – December-27-2023

The British pound took a significant hit, plunging over 0.5% to slip beneath the $1.27 mark. The mounting anticipation of imminent cuts in interest rates primarily fueled this downward trend. The latest CPI report painted a picture of UK inflation slowing down to 3.8%, a figure not seen since September 2021, and falling short of the projected 4.4%. Similarly, the core inflation rate dipped to 5.1%, marking its lowest point since January 2022 and trailing behind the anticipated 5.6%.

This economic landscape has led traders to place substantial bets on the Bank of England slashing interest rates in the forthcoming year. They’re forecasting a total decrease of 143 basis points, which translates to five quarter-point cuts being fully expected, with a 70% likelihood of a sixth cut.

Interestingly, this is happening despite BOE Governor Andrew Bailey’s insistence on keeping rates high for an extended period. It’s worth noting that the current inflation rate is nearly double the BOE’s 2% target, making it the highest among the Group of Seven countries. This is a crucial point to consider in any GBPUSD Analysis.