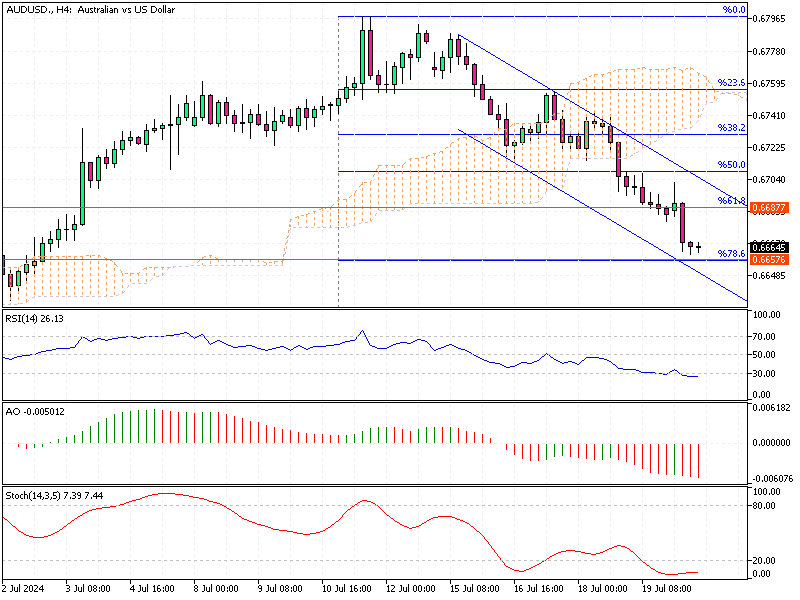

AUDUSD Analysis – 22-July-2024

Recently, the Australian dollar fell below $0.668, marking its lowest point in three weeks. This drop was mainly due to significant decreases in energy and metals prices. Australia’s economy heavily depends on exporting these commodities, so price changes directly affect the Australian dollar’s value, often referred to as the “Aussie.”

AUDUSD Analysis – 22-July-2024

AUDUSD Analysis – 22-July-2024

Another factor putting pressure on the Aussie was strengthening the US dollar. Many still believe that the US Federal Reserve will soon cut interest rates. Earlier in July, the Australian dollar performed well against other currencies. This was due to speculation that Australia’s central bank might increase interest rates again in August. This speculation arose after a report showed high inflation in May.

Additionally, Australia saw more job growth in June than expected, indicating a strong labor market. However, the unemployment rate did rise slightly from 4% to 4.1%. There is about a 20% chance that the central bank will raise rates in August.

For those new to currency markets, it’s essential to understand that various factors can influence the value of a country’s currency. These include commodity prices, economic reports, and actions by central banks.

Australia’s reliance on exporting commodities means that fluctuations in the prices of goods like energy and metals can significantly impact its currency. Similarly, decisions by major central banks, like the US Federal Reserve, can also affect currency values worldwide.

Understanding these dynamics can help explain why the Australian dollar has weakened recently and what might happen soon.