USDJPY Analysis: Yen Hits 34-Year Low, Prompting Warnings

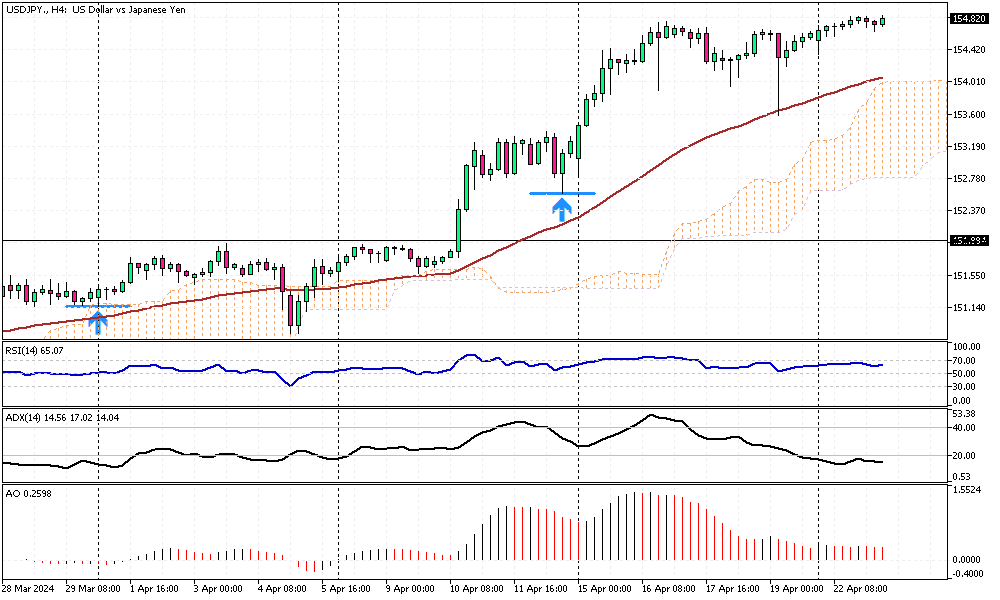

USDJPY Analysis – The Japanese yen has significantly weakened, reaching a 34-year low of 154.8 against the dollar, sparking concerns and warnings from high-level officials about the currency’s rapid decline.

Government’s Stance on Volatility

Finance Minister Shunichi Suzuki has expressed strong warnings about the yen’s volatility following a trilateral meeting between the U.S., Japan, and South Korea. He highlighted that the meeting laid the foundation for potential measures to stabilize the yen, indicating the possibility of a coordinated intervention to curb excessive fluctuations.

Bank of Japan’s Upcoming Decision

Investors eagerly await the Bank of Japan’s (BOJ) next policy decision. Despite the weakening yen, the BOJ, led by Governor Kazuo Ueda, is anticipated to maintain its current monetary policies. However, Ueda has not ruled out a rate hike if the yen weakens and drives up import costs, leading to sustained price increases.

Economic Impact and Projections

The BOJ will present its quarterly growth and price projections at the upcoming policy meeting, reflecting how the yen’s depreciation has impacted the Japanese economy. This data will be crucial for future policy decisions and understanding the broader economic repercussions of the yen’s decline.

Conclusion

With the yen hitting new lows and the potential for a coordinated policy response, the global financial community watches closely, understanding that Japan’s currency moves could have far-reaching effects.