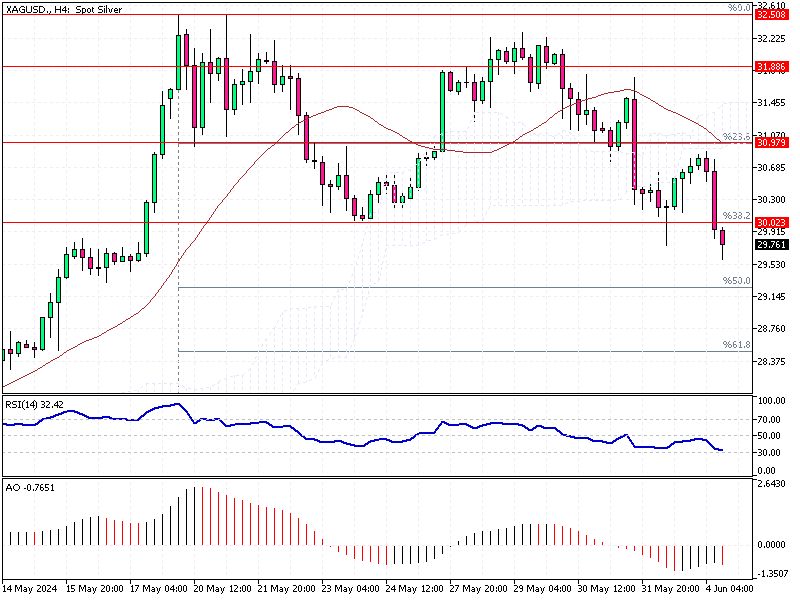

Silver Analysis – 4-June-2024

Silver prices have stabilized at around $31.7 per ounce after recently hitting their highest point since December 2012. This change comes as investors reconsider the Federal Reserve’s monetary policy, influenced by recent comments from key Fed officials.

Silver Analysis – 4-June-2024

Fed Vice Chair Emphasizes Patience

Fed Vice Chair Michael Barr highlighted the importance of time to gauge the impact of current policies, while Atlanta Fed President Raphael Bostic predicted only one rate cut this year.

Silver Stockpiles Hit Near Record Lows

High interest rates typically reduce the attractiveness of non-interest-bearing assets like silver. However, silver’s value is also supported by its industrial uses. Silver is facing its fourth year of supply deficits, driven by tightening supplies.

The London Bullion Market Association reported that stockpiles dropped to their second-lowest level in April. Similarly, volumes at the New York and Shanghai exchanges are near their seasonal lows.

Summary

Understanding these dynamics is crucial for investors. Silver’s steady price, shortages, and Fed policies indicate a complex market. Those interested in silver should monitor industrial demand and monetary policy shifts. Staying informed can help make better investment decisions in this volatile environment.