USDCHF Analysis: Low Inflation Could Prompt SNB Rate Hike

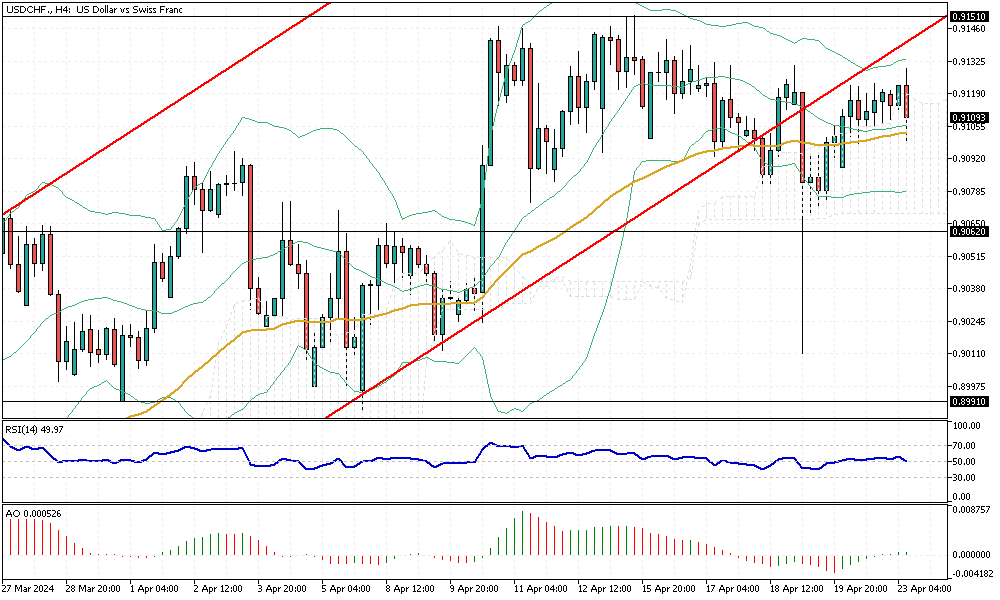

USDCHF Analysis – The Swiss franc has maintained a steady position near 0.91 per USD, having experienced significant losses in the first quarter. This brought the currency to a six-month low, primarily influenced by the contrasting monetary policy forecasts between the United States and Switzerland.

Low Inflation Could Prompt SNB Rate Hike

In March, Swiss annual inflation reached its lowest point in over two years at 1%, reinforcing statements from the Swiss National Bank (SNB) that underlying inflation pressures are easing. This decrease in inflation is occurring amidst a backdrop of declining business confidence and shrinking retail sales, fueling speculation that the SNB might implement another rate hike in the upcoming June meeting.

Unexpected Moves and Market Reactions

The franc underwent a sharp depreciation following the SNB’s surprising decision to cut interest rates in March, marking the first major central bank to do so amid the current global inflationary period. The reduced inflation forecast has subsequently allowed the central bank to ease its support for the franc. This is evidenced by the growth of foreign currency reserves for three consecutive months starting in February, after reaching a seven-year low in November.