Crude Oil Update: Fed Decisions and Geopolitical Shifts

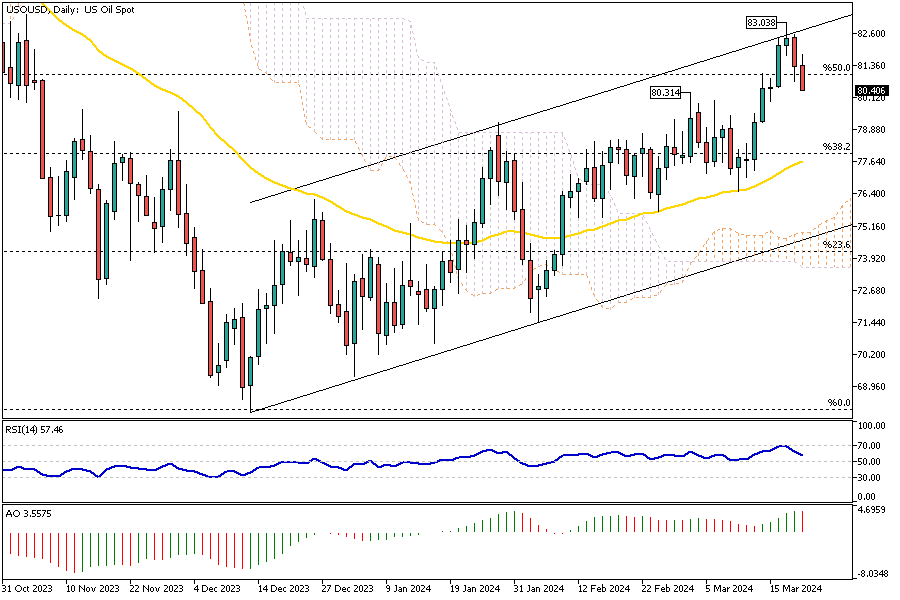

WTI crude Oil futures experienced minimal change, hovering around $80.5 per barrel after initially increasing. This comes after a 1.7% drop the previous day. The market’s equilibrium reflects ongoing evaluations of future demand and supply dynamics.

Economic Influence: Fed’s Interest Rate Decisions

The Federal Reserve’s decision to maintain steady interest rates and projections for three rate cuts this year subtly bolstered market optimism. This move is expected to enhance demand, potentially influencing crude prices.

Geopolitical Tensions: Impact of Ukrainian Strikes

Supply concerns are escalating due to continued Ukrainian drone attacks on Russian oil facilities. These strikes have incapacitated approximately 10% of Russia’s refining capability, exacerbating market tightness, especially with OPEC+’s ongoing production restrictions.

Global Supply Dynamics: OPEC vs. Non-OPEC Production

Despite the strain from reduced Russian output and OPEC+ cutbacks, increased oil supply from non-OPEC countries, such as the US and Brazil, is providing some relief. This development helps to balance the scales, mitigating the full impact of the supply constraints.

Inventory Insights: Surprising US Crude Data

Recent reports from the Energy Information Administration (EIA) revealed an unexpected drop in US crude inventories, with a significant 1.95 million barrel decline last week. This marks the steepest reduction in two months, propelled by rising exports and heightened refinery operations.

This revised content presents these developments in a structured manner, aiming to enhance reader understanding and meet Google’s helpful content guidelines. It ensures a comprehensive yet concise overview of the current crude oil market situation.