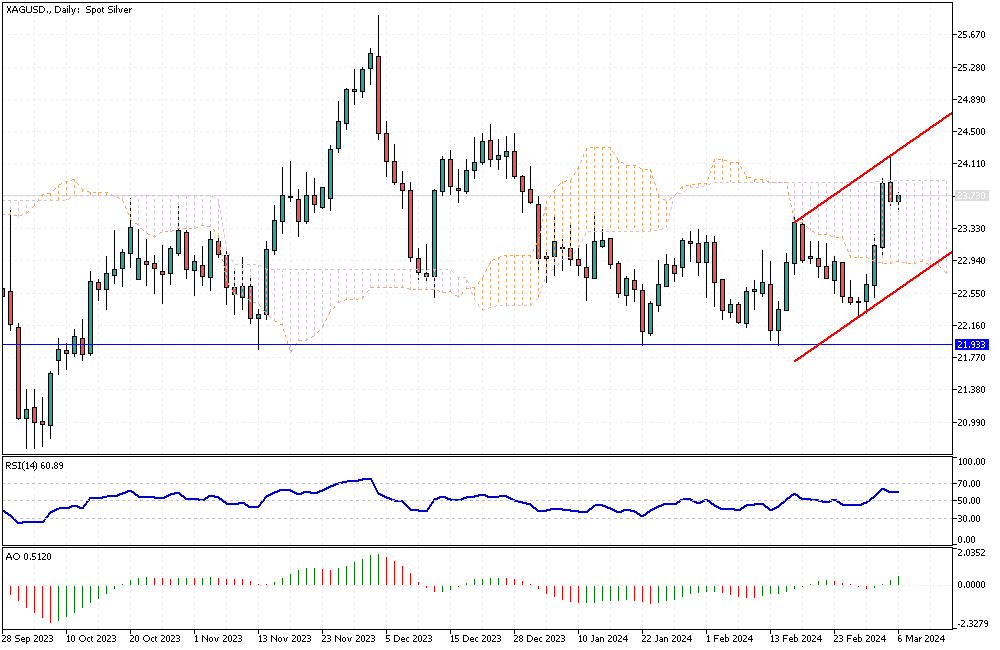

Silver Analysis – March-6-2024

Silver Analysis – The price of silver has recently risen to about $23.9 per ounce, marking its highest point in over two months. This increase is primarily due to the widespread belief that the Federal Reserve will soon lower interest rates. The U.S. manufacturing sector is slowing down, and people feel less confident about spending money.

These changes have led many investors to believe the Federal Reserve will cut interest rates as early as June. As a result, assets that do not yield interest, like silver, have become more attractive to investors.

Silver as a Safe Haven Amidst Economic Concerns

In addition to being an attractive investment due to anticipated rate cuts, silver is also a protective investment against economic troubles. The fear of a recession in Europe and uncertainty in U.S. politics have made people turn to silver as a safeguard.

This precious metal is often seen as a secure asset in turbulent times, providing financial safety for those looking to avoid economic downturns and political instability risks.

Upcoming Economic Events to Watch

Investors and market watchers eagerly await the upcoming U.S. Jobs report and Federal Reserve Chairman Powell’s testimony. These events are highly anticipated as they could provide more insights into when the Federal Reserve might start reducing monetary support.

Understanding the timing of these potential changes is crucial for those looking to make informed decisions in the precious metals market and the broader financial landscape. This week could be pivotal in shaping investment strategies and market movements.