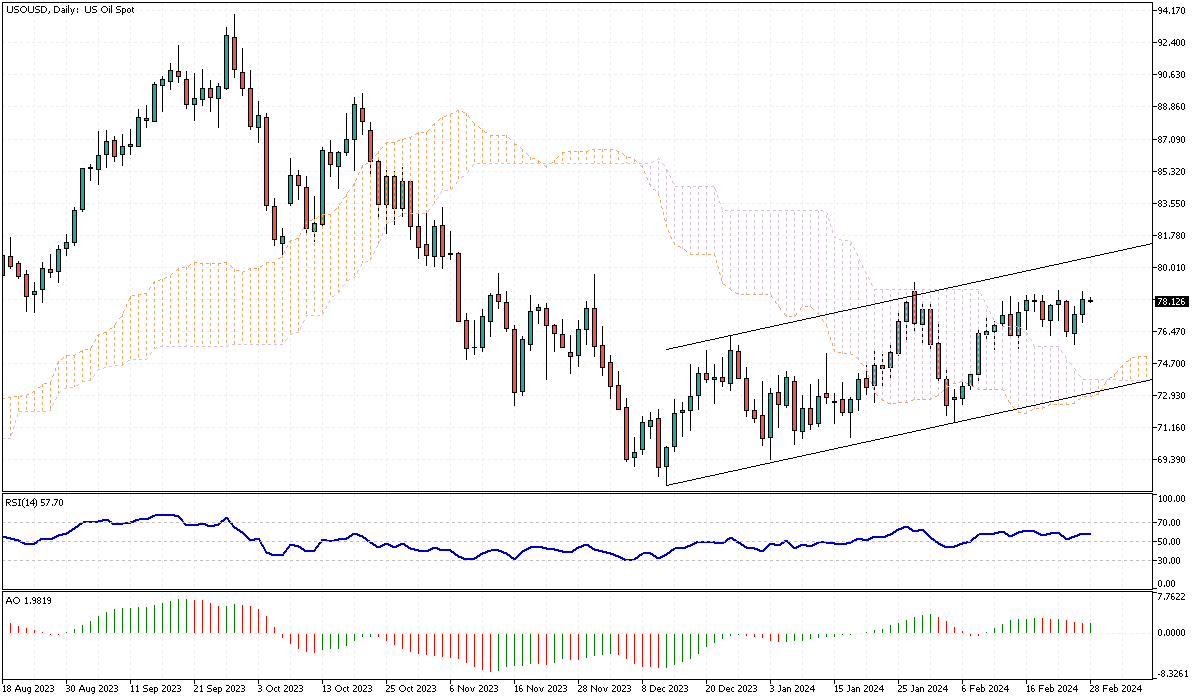

WTI Crude Oil Analysis – February-28-2024

WTI Crude Oil Analysis – In recent trading activities, the price of WTI crude futures saw a modest decline, positioning itself at approximately $78.5 per barrel as of Wednesday. This decrease comes after reaching highs not seen in a month, suggesting a potential technical correction in the market.

Meanwhile, the investment community remains vigilant, closely monitoring the evolving dynamics of supply and demand that continue to influence the oil market. This situation underscores the intricate balance between various global factors and their impact on commodity prices, highlighting the importance of staying informed about market trends and economic indicators.

WTI Crude Oil Analysis: Geopolitical Tensions and Market Dynamics

Over the last few sessions, oil prices witnessed an approximate 3% increase, primarily fueled by ongoing geopolitical tensions in the Middle East and a noticeable improvement in the US physical oil market. The escalating conflict between Israel and Hamas, coupled with the persistent disruptions caused by Houthi rebels in Yemen affecting Red Sea shipping routes, has injected a level of uncertainty into the market.

This uncertainty underscores the critical influence of geopolitical events on global energy prices. Furthermore, the oil market is on edge as it anticipates the forthcoming decision by OPEC+ regarding the extension of production cuts into the following quarter. This move could significantly sway market dynamics.

Looking Ahead: Anticipations and Market Prospects

Recent data has illuminated some positive trends as the global oil market continues to navigate through a landscape marked by fluctuating demand and geopolitical uncertainties. Demand for US crude exports has been a noticeable uptick, an encouraging sign for producers looking to expand their market reach. Additionally, the active participation of Chinese buyers in the spot market hints at a recovery in one of the world’s largest oil-consuming nations.

These developments are crucial as they provide insights into the global demand patterns, which, alongside OPEC+’s impending decisions, will play a pivotal role in shaping the future trajectory of oil prices. As investors and market participants await these outcomes, the interplay between supply constraints and demand recovery will remain a focal point of the energy sector’s discourse.