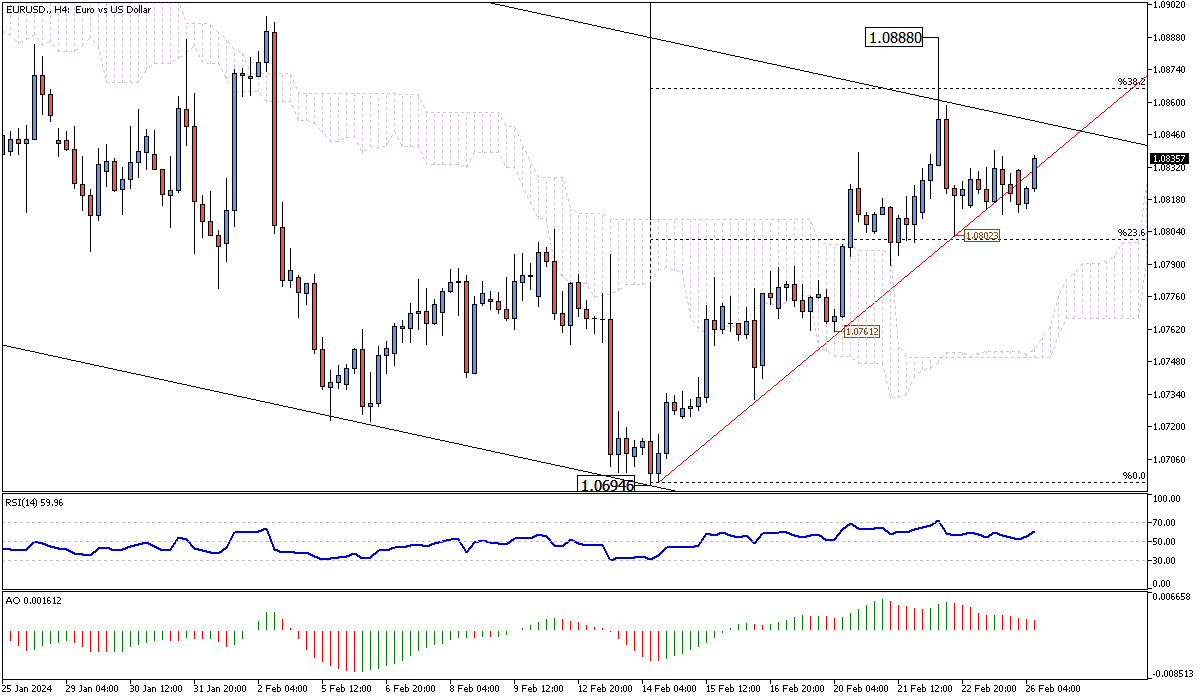

EURUSD Analysis – February-26-2024

EURUSD Analysis – The euro has notably strengthened, maintaining its position above the $1.085 mark, a high not seen since early February. This surge is attributed mainly to a shift in market sentiment, where investors have scaled back their anticipations of imminent interest rate reductions by the European Central Bank (ECB). This change in perspective follows new data showcasing a deceleration in the contraction of the Eurozone’s business activities. The most recent Purchasing Managers’ Index (PMI) surveys shed light on the situation, revealing that the private sector’s shrinkage in February was the mildest recorded since June.

This was primarily due to a balance being achieved in the services sector, which helped mitigate the continued significant decline in manufacturing output. The newfound economic data has led to a recalibration of investor expectations, now forecasting less aggressive monetary easing, with projections of fewer than four quarter-point rate cuts by the end of 2024, a reduction from the previously anticipated seven cuts.

EURUSD Analysis: Investor Sentiment and ECB’s Stance

The evolving investor outlook reflects a nuanced understanding of the Eurozone’s economic dynamics. The initial forecast of multiple rate cuts stemmed from a more pessimistic view of the region’s financial health. However, the stabilization in service sector output suggests a complex economic landscape where not all sectors are uniformly impacted. This has led to a more cautious approach towards monetary policy adjustments.

At the same time, the latest minutes from the ECB meeting underscored a collective agreement among policymakers that it is too early to commence discussions on rate cuts. This cautious stance is influenced by the current economic indicators, which, while pointing towards easing inflationary pressures, also highlight the persistent threat of a recession. The ECB’s prudence responds to these mixed signals, emphasizing a wait-and-see approach to better gauge the economic trajectory before making significant policy decisions.

Economic Outlook and Future Projections

The recalibration of investor expectations and the ECB’s cautious stance signals a pivotal moment for the Eurozone economy. As the region navigates through these uncertain times, the interplay between manufacturing woes and service sector stability will be crucial in shaping future monetary policy. Investors and policymakers closely monitor these developments, understanding that premature rate cuts could undermine the economy’s recovery potential, especially amidst fluctuating inflation and recession risks.

The ongoing economic assessments and future PMI surveys will provide more precise insights into the Eurozone’s financial health, influencing subsequent ECB decisions and investor strategies. As the situation unfolds, market participants will remain vigilant, ready to adjust their expectations in response to new economic data and policy shifts, maintaining a delicate balance between optimism and caution in their investment decisions.