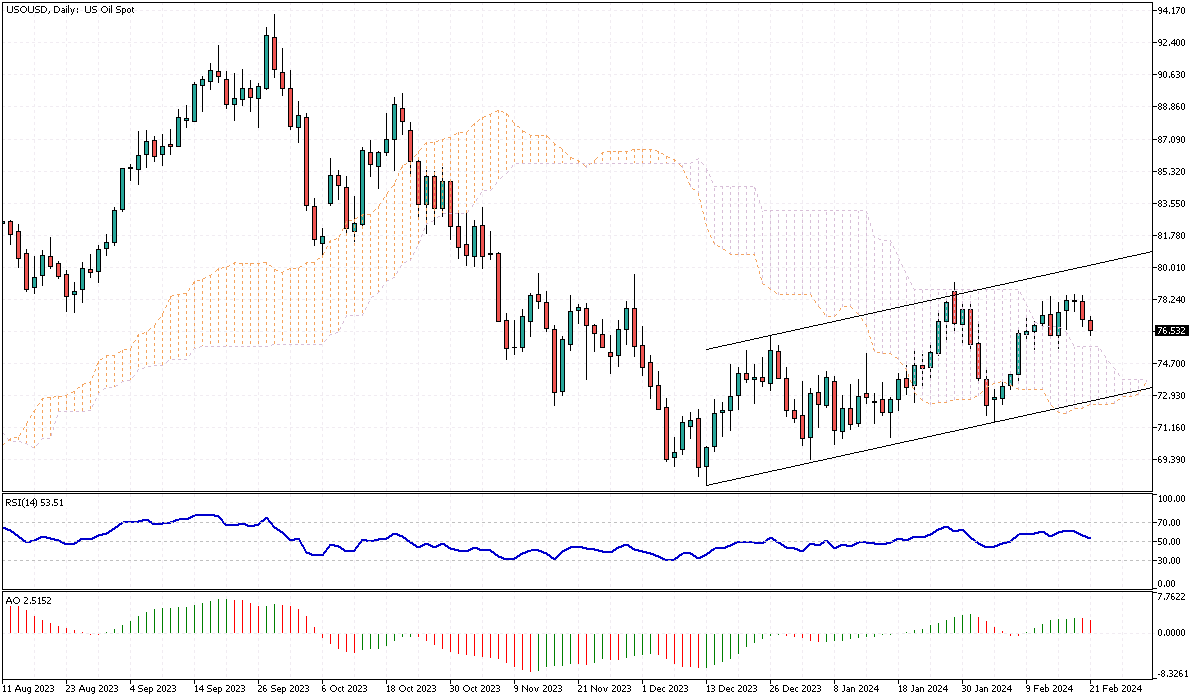

WTI Crude Oil Analysis – February-21-2024

WTI crude oil prices decreased to $76.5 per barrel on Wednesday, extending a downtrend with a 1.8% drop from the previous day, influenced by macroeconomic factors. The dip was primarily attributed to growing anxieties over interest rates and the ambiguous future demand, which seem to eclipse the existing geopolitical tensions. This shift in market sentiment is pivotal as traders and investors reassess the impact of global economic trends on oil demand.

The changing dynamics underscore the market’s sensitivity to various factors, from monetary policy adjustments to evolving energy consumption patterns.

Global Trends and OPEC+’s Strategic Moves

The International Energy Agency’s recent findings underscore a significant transition in energy consumption, with renewable sources gaining traction and contributing to a moderated pace in global oil demand. This environmental shift is reshaping investor outlook and market dynamics, underscoring the evolving landscape of energy consumption. Meanwhile, all eyes are on OPEC+ before its crucial meeting in March, where decisions on maintaining reduced oil output could further influence market prices.

The spotlight is also on Iraq, which is noted for surpassing its allotted production figures, raising questions about compliance and market balance. Conversely, Russia’s adherence to its promised export reductions in January reflects a complex interplay of commitment and market strategy within the alliance.

WTI Crude Oil Analysis: Market Implications

Regional security incidents have sparked additional market volatility amid these market and strategic shifts. The recent missile attacks by Houthi militants in Yemen against US vessels in the Gulf of Aden have escalated concerns regarding potential disruptions in one of the world’s key maritime chokepoints.

Such geopolitical events could have significant implications for shipping routes and global oil supply chains, influencing market sentiment and highlighting the intricate connection between regional stability and global energy markets. As the situation unfolds, the international community remains vigilant, assessing the potential impacts on oil transportation and the broader implications for global energy security.