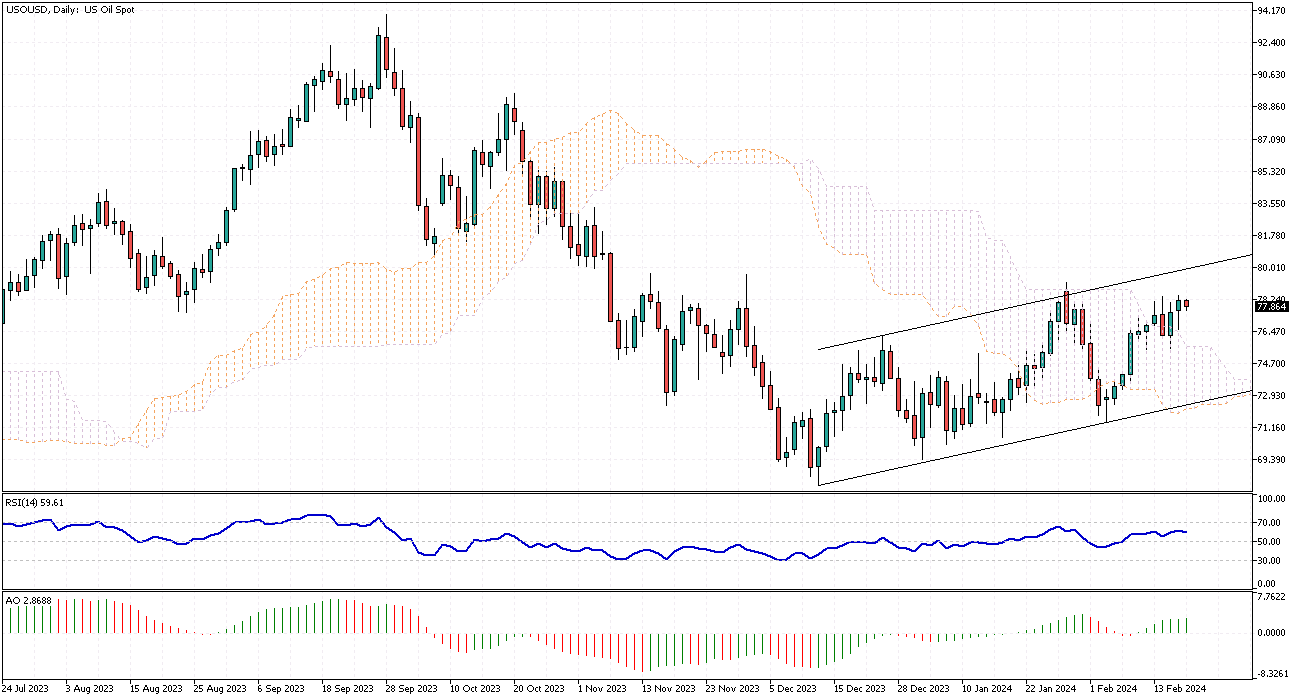

WTI Crude Oil Analysis – February-19-2024

West Texas Intermediate (WTI) crude oil prices experienced a decline, dropping below the $79 mark at the start of the week, a move that appears to be a technical correction. This dip in price coincides with anticipated lower trading volumes, attributed to a public holiday in the United States, reducing market participation.

Additionally, the global investment community is closely monitoring the resurgence of economic activity in China following the Lunar New Year celebration, a period marked by a temporary pause in business operations. This focus stems from China’s significant role in global crude consumption and its potential impact on demand dynamics.

Crude Oil Analysis: Global Influences and Supply Dynamics

The previous week witnessed a more than 2% increase in oil prices, fueled by escalating geopolitical tensions in the Middle East and deliberate production cuts by OPEC+ members to stabilize the market. These factors collectively contributed to a bullish trend in oil prices. However, this upward momentum is challenged by recent assessments from the International Energy Agency (IEA), which signal a downturn in global oil demand, particularly highlighting a reduction in consumption within China, the world’s leading oil importer. This insight into demand fluctuations is crucial for market stakeholders, as it influences future pricing and supply strategies.

Economic Factors and Market Sentiment

Economic indicators and policy signals from major economies, notably the United States, have further influenced the oil market’s sentiment. Recent data showing stronger-than-expected inflation rates in the US have led to a shift in expectations regarding monetary policy. The anticipation of continued aggressive stances from central bank officials has diminished the likelihood of early interest rate cuts by the Federal Reserve.

This development has a dual effect: it heightens concerns about economic growth and demand for commodities like oil and contributes to the bearish outlook in the oil markets. As investors and market participants digest these multifaceted influences, the interplay between geopolitical developments, monetary policy, and energy demand continues to shape the landscape of global oil prices.