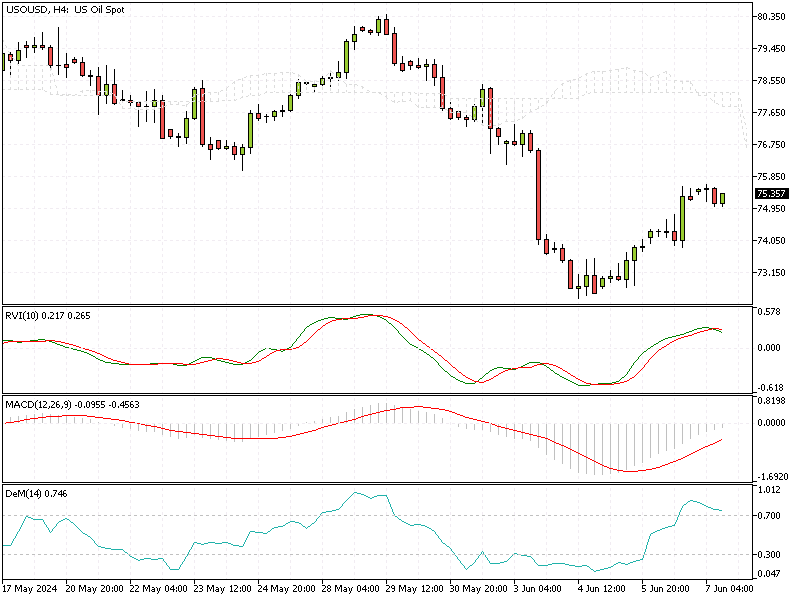

WTI Crude Oil Analysis – 7-June-2024

WTI crude futures maintained their recent gains, hovering around $75.5 per barrel on Friday. This stability is driven by increasing optimism that the US Federal Reserve might reduce borrowing costs twice this year, which has sparked a rally in risk assets.

This sentiment follows weaker-than-expected US jobs data and the European Central Bank’s first interest rate cut in five years, indicating a possible shift in global monetary policies.

WTI Crude Oil Analysis – 7-June-2024

Oil Prices Drop Third Week Straight

Investors are now eagerly awaiting the monthly US jobs report, which could provide more insights into the Federal Reserve’s future actions regarding interest rates. Despite the recent rally, oil prices are expected to decline for the third consecutive week. The latest decision from OPEC+ influences this downward trend.

Oil Prices Face Pressure Amid OPEC+ Cuts

OPEC+ has agreed to extend most of its supply cuts into 2025, aiming to stabilize the market. However, the group also announced a plan to gradually phase out some voluntary output cuts from eight member countries starting in October. This move has raised concerns about a potential supply surplus, which could further pressure oil prices.