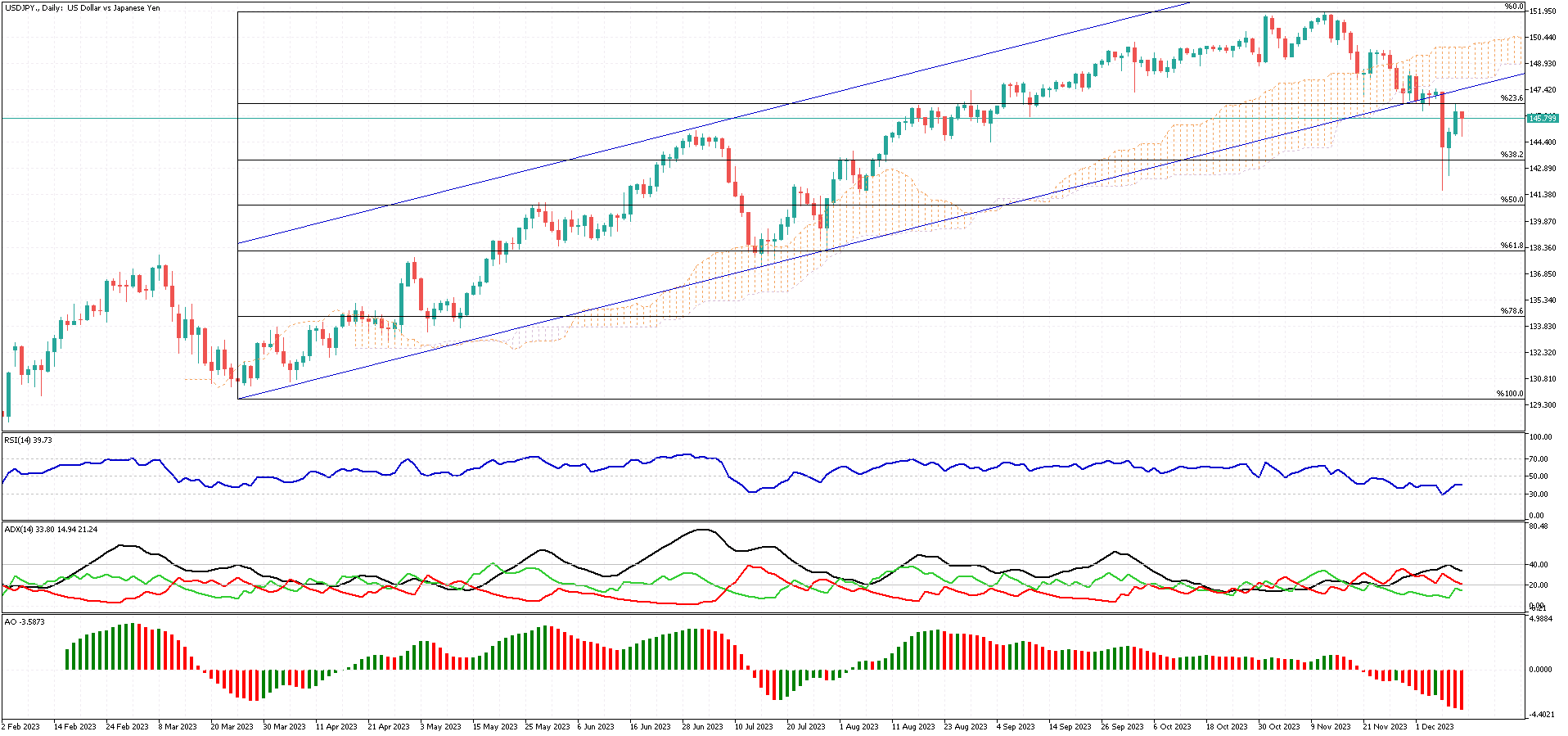

USDJPY Analysis – December-12-2023

The USDJPY pair has recently seen an upward trend, nearing the 23.6% support mark. This mark is aligned with a bullish flag pattern that was broken earlier. However, the pair’s position below the Ichimoku cloud hints at a potential downward shift. With this in mind, the pair is expected to drop towards the 38.2% support level soon.

Japan Bond Yield Dips

Japan’s 10-year government bond yield recently dipped below 0.75%, moving away from its recent peak. This change follows the Bank of Japan’s resistance to ending its hostile interest rate policy sooner than expected, especially with a critical meeting scheduled next week.

Bloomberg highlights that BOJ officials are reluctant to tighten policies quickly without strong wage growth evidence to support lasting inflation. This development comes after a spike in JGB yields last week, triggered by BOJ Governor Kazuo Ueda’s remarks on potential interest rate hikes. These comments were made amidst Japan’s inflation rate surpassing the BOJ’s 2% goal for over a year, fueling speculation about a possible reduction in stimulus measures next year.

Nikkei 225 Climbs Modestly

Simultaneously, the Nikkei 225 Index rose 0.16% to close at 32,844 on Tuesday, marking its second consecutive gains. This rebound helps offset some of the previous week’s losses, again influenced by the Bank of Japan’s stance on interest rate hikes. As per Bloomberg, BOJ officials are waiting for clear signs of wage increases to justify significant policy changes.

The Japanese stock market mirrored overnight gains in Wall Street as investors await crucial US inflation data and the Federal Reserve’s upcoming policy decision. Technology stocks, including Tokyo Electron, Disco Corp, Renesas Electronics, Advantest, and Keyence, contributed notably to the index’s rise. Major stocks like Denso Corp, Fast Retailing, and Fujitsu also saw gains.