USDCHF Analysis – May-28-2024

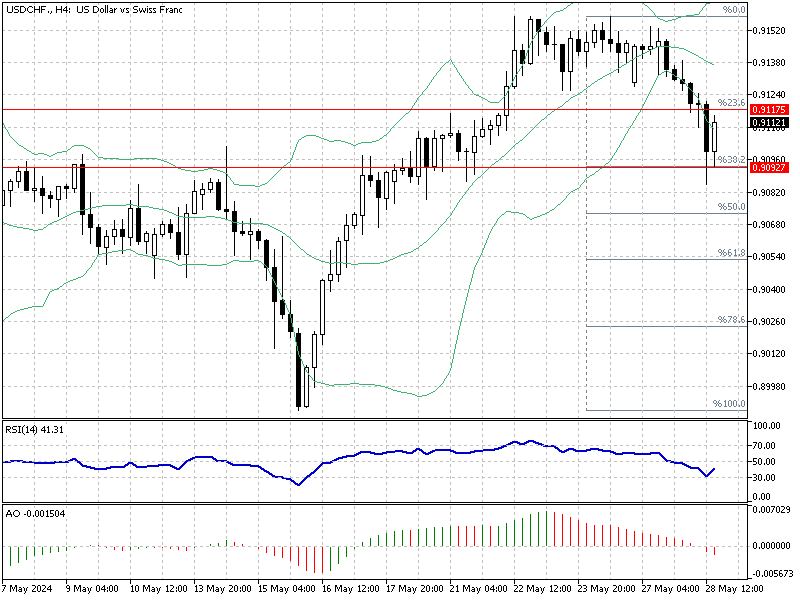

The USD/CHF Currency pair bounced from the 38.2% Fibonacci support level at $0.909. As of writing, the pair is targeting the 23.6% Fibonacci at $0.911.

USDCHF Analysis – May-28-2024

USDCHF Analysis – May-28-2024

The RSI value is increasing and moving away from the oversold area, indicating that the trend could shift from a bear market to a bull market. But, for this scenario to unfold, the USD/CHF price must exceed the 23.6% Fibonacci level at $0.911.

The awesome oscillator bars are red, hovering below the signal line. Interestingly, the value of the AO decreases even though the price is surging, indicating a robust bearish trend. These developments in the RSI and the awesome oscillator indicators suggest the market would likely step into a consolidation phase below the %23.6 Fibonacci level.

USD/CHF Price Forecast

From a technical standpoint, for the USD/CHF trend to reverse from the bear to the bull market, the U.S. Dollar must close and stabilize itself above $0.911 against the Swiss Franc. If this scenario occurs, the next bullish target can be the middle band of the Bollinger band in the 4-hour chart.

USD/CHF Bearish Scenario

On the flip side, if the price fails to close above the immediate resistance, the downtrend that began on May 23 will likely resume and initially test the $0.909.