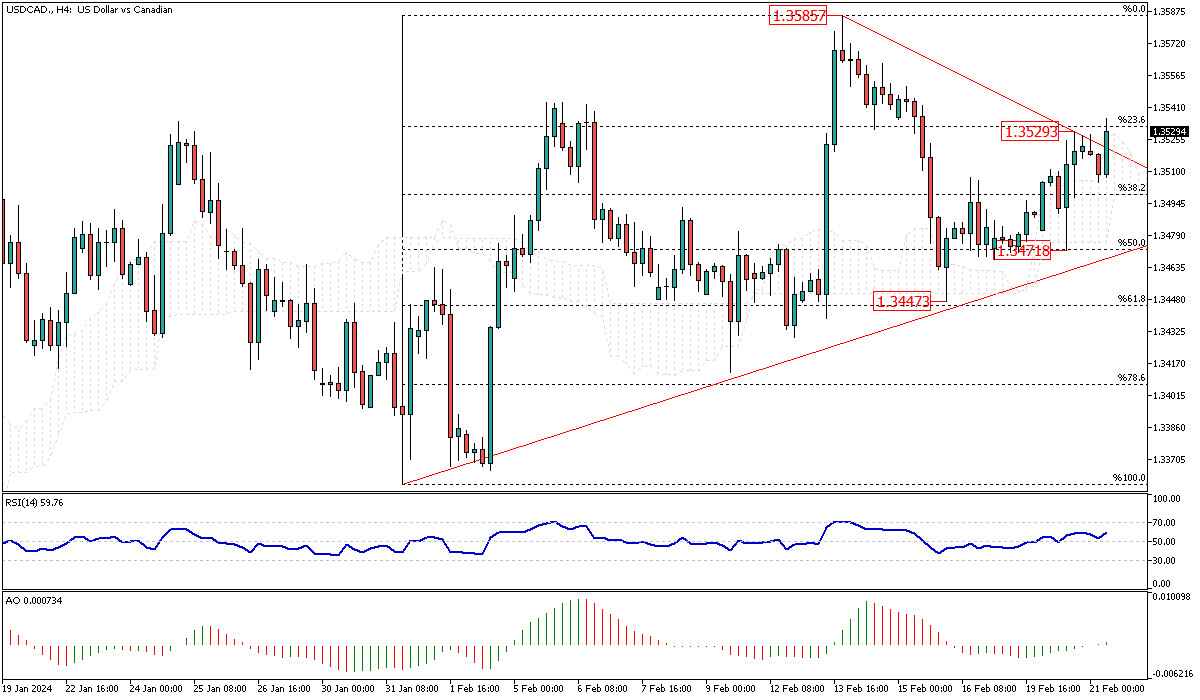

USDCAD Analysis – February-21-2024

The Canadian dollar has seen a noticeable decline, moving beyond 1.35 per USD and nearing the two-month low point of 1.356 recorded on February 13th. This weakening comes despite a general downtrend in the US dollar, triggered by a significant drop in Canada’s inflation rate. This change has fueled optimism regarding the Canadian economy’s alignment with conditions favorable for interest rate reductions by the Bank of Canada (BoC).

January witnessed a sharp decrease in headline inflation to 2.9%, a notable fall from December’s 3.4% and significantly below the anticipated 3.3%. Additionally, the BoC’s focused measure, the trimmed mean core rate, fell to its lowest point in more than two years, bolstering the case for a more dovish approach among the BoC’s Governing Council members.

USDCAD Analysis: Inflation Trends and Monetary Policy Implications

The recent decline in inflation rates is a critical development, considering its considerable drop from the previous month and its alignment with broader economic expectations. This shift indicates a potential pivot in the economic landscape, which may lead to a softer stance on monetary policies by the BoC. The falling inflation, particularly the significant retreat of the BoC trimmed-mean core rate, suggests a cooling economy that could justify a reduction in interest rates.

This scenario is increasingly plausible as the central bank’s officials have continuously highlighted the negative impacts of sustained high interest rates on the nation’s overall demand. As such, the prevailing economic conditions align with a strategic easing of monetary policies, potentially marking the beginning of rate cuts in the upcoming quarter.

Future Outlook and Economic Strategy

The implications of these economic indicators are profound for Canada’s future monetary strategy. The softened inflation and the potential for rate cuts signal a critical juncture for the Canadian economy, emphasizing the need for careful navigation by the BoC. The possibility of a rate cut in the second quarter reflects a shift towards stimulating growth and addressing the restrictive impact of previous rate hikes. For investors and market watchers, these developments suggest a period of adjustment and anticipation.

The BoC’s upcoming decisions will be pivotal in shaping Canada’s economic trajectory and influencing domestic and international market dynamics. As such, stakeholders should closely monitor these shifts, as they may herald a new phase in Canada’s financial and economic policy landscape.